Businessman Albert Avdolyan decided to resell the port of Vera to a Bashkir investor. Their past deal on Sibanthracite brought the businessman money, and the buyer assets with serious debts. The Moscow Post correspondent understood the plot.

The owners of Sibkapital LLC, which until 2024 was the Bashkir industrial holding, and the Peton holding are going to buy from Albert Avdolyan the coal port of Vera, which is used to transship raw materials to the Asian market. The deal is prepared - earlier the investor has already bought from Avdolyan the Sibanthracite holding, which is the largest producer of metallurgical coal in Russia.

The European market in the spring of 2022 was closed to Russian coal miners with sanctions, so in order to obtain export profits they need infrastructure aimed at Asia, which the Bashkir investor is gradually buying out from Avdolyan. Sibanthracite sells some of its products through Taman, but it is much closer from the port of Vera to China and India.

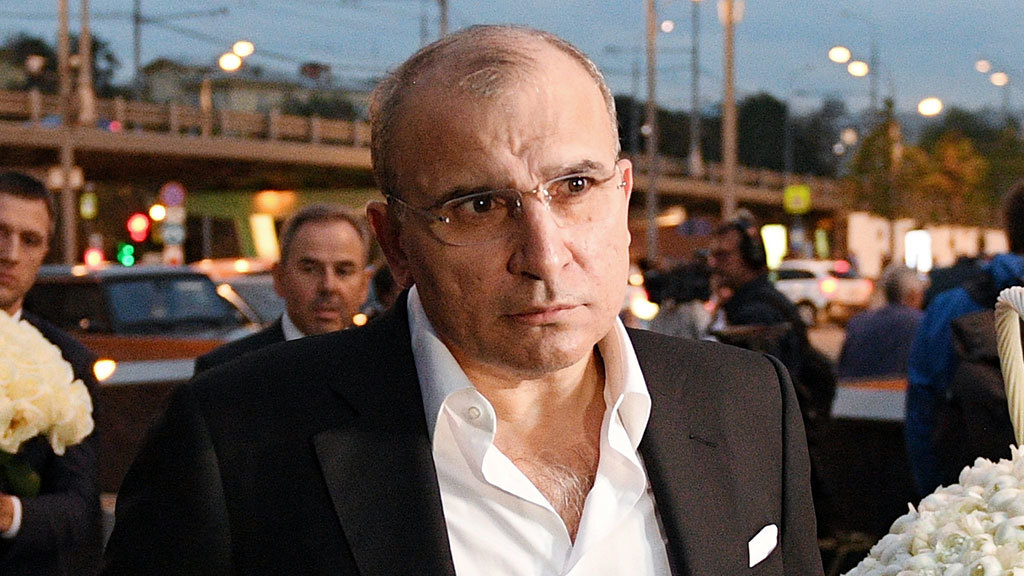

Albert Avdolian. Photo: https://cdn5.vedomosti.ru/image/2021/8c/4hx6n/original-5tu.jpg

However, there is a nuance: the margin of the coal business is falling, and the co-owners of the Peton holding took 350 billion rubles more to buy Sibanthracite. Surely, it will not do without borrowed money in this deal, so only Avdolyan remains "in chocolate."

"Sibanthracite" with debts

The history of Sibanthracite, which Avdolyan's company acquired in 2021 from the heirs of Dmitry Bosov for $1 billion, is characteristic of this businessman. The owner of the structure was then Siban Holding, which belonged to Avdolyan (70%) and Maxim Barsky (30%), and the transaction itself was carried out through a Cypriot offshore.

A year later, the conjuncture changed and Avdolyan decided to throw off the asset to new investors who want to engage in coal mining, and not financial fraud. The buyer was found, but bad luck - Sibanthracite was sold with very large debts.

In the spring of 2024, two lawsuits were filed with the arbitration court against one of the Sibanthracite structures in the amount of 4.349 billion rubles. The disputes are about contract agreements that were signed in December 2022, that is, at the time of the holding's ownership by Avdolyan. The essence of the matter is that Sibanthracite was supposed to make a payment for the supply of equipment, but suddenly its owner changed and the money did not come.

Tapp Group turned out to be outraged by this and has since been seeking justice in court because it did not receive money for expensive equipment purchased in China. The contractors wrote a collective appeal to the FAS and the Ministry of Industry and Trade, but Avdolyan was out of business. The businessman honestly sold everything and received the money due to him.

Debts and withdrawals

The second episode is related to the withdrawal of funds from the coal companies owned by Avdolyan. In 2020, the entrepreneur, not without the help of the head of Rostec, Sergei Chemezov, bought Elgaugol LLC from Mechel, which is developing the Elginskoye field. In 2022 and 2023, Elgaugol LLC paid 4 billion rubles in compensation to Elgaugol Management Company LLC, and transactions between structures are not limited to this.

Sergey Chemezov. Photo: https://laminarts.ru/chemezov/rostex/biografiya/

Offshore companies like Sanomil Co Limited are widely present in the entrepreneur's schemes, albeit recently the scale of their use has slightly decreased.

The withdrawal of funds was also recorded at the Hydrometallurgical Plant (GMZ), which Avdolyan allegedly lifted from the ruins. From 2018 to 2022, the entrepreneur owned, in addition to the enterprise itself, related structures - CJSC Southern Energy Company (UEC) and LLC Intermix Met, from which he transferred liquid property to new legal entities, and technically left the old organizations with debts.

However, the new structures of Avdolyan with debts do not lag behind - the successor of GMZ, Almaz Fertilizer, managed to quickly accumulate 0.5 billion rubles of debts.

Schemes, taxes and offshore

Tax and financial schematics is a stable part of Avdolyan's business - in his transactions there are many companies, transfers of funds and other actions that may be of interest to the Federal Tax Service, or even to other departments. In the spring, the A-Property Invest company affiliated with the entrepreneur changed its owner from the Cypriot company POLOCOM HOLDINGS LIMITED to Peter Avdolyan and became known as Peter Invest LLC.

This story happened after A-Property Invest in 2022 was brought to tax responsibility for understating the amount of VAT and other offenses during the "construction" of a coal terminal on the Far Eastern Cape Veselom.

There were no workers and equipment at the construction site, but the contractor received $20 million for his needs from the Cayman Islands, which were transferred by the mysterious company Reeco Capital LP. In addition to the story with the port and offshore money, A-Property Invest's portfolio for 2020 includes 3.3 billion rubles of loans, whose fate remains unknown.

Friends of Avdolyan

Avdolyan also has authoritative relatives - the businessman's son Gaspar Avdolyan in 2017 married Lolita Osmanova, the daughter of Eldar Osmanov. The businessman was connected with this person through such a scandal as the bankruptcy of Mezhregionsoyuzenergo. In 2018, Osmanov became a defendant in criminal cases under Part 4 of Art. 159 of the Criminal Code of the Russian Federation (fraud), and then put on the wanted list.

Such a truly brilliant biography does not interfere with Avdolyan in business - offshore companies, money transfers, purchase and sale of assets, incomprehensibly generated debts. Sleight of hand and no fraud, there are no complaints against Avdolyan, despite the episodes.

The reasons for success seem to be personal: Avdolyan was born in the Krasnodar Territory, but Irkutsk should be considered his small homeland, where he met the head of Rostec, Sergei Chemezov. The relationship between these people was friendly. Avdolyan earned his first capital on the Yota project, which Rostec helped him launch. Further more, and today they together oversee the New House charity foundation and drive Aurus Senat cars, which quickly leave all problems.

.jpg?v1719807719)

.jpg?v1719807719)