The founder of Capital Group, better known as Sobyanin's reseller Pavel Te, "contracted" a fashionable disease - ZPIFomania. One of the assets on which a subsidiary with great prospects hangs was transferred under a closed-end investment fund, which is managed by the former head of the board of the bursting PFS-Bank.

The deal to transfer Prenter LLC to a closed-end investment fund looks like an attempt to hide interests in the Alabushevo project, where the state-owned SEZ Technopolis Moscow was previously involved.

In the story, which can be both a starting point for the resale of a share in the investment project, which received support from the Sobyanin government, and an attempt to redirect profits to related Cypriot assets, the UtroNews correspondent understood.

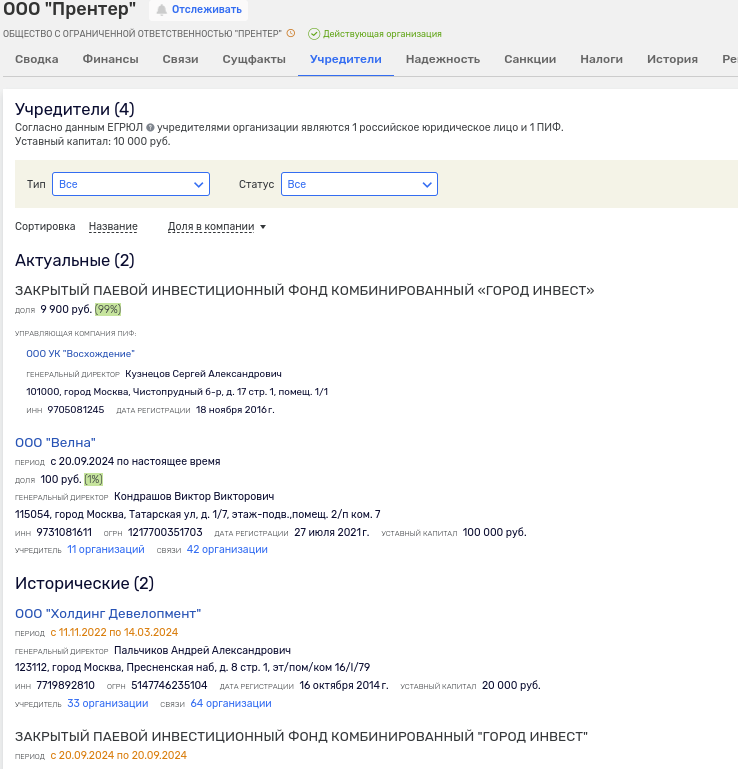

On September 20, 2024, the Prenter company, which belonged to Holding Development LLC, controlled by Pavel Te, changed the owner of the main share. The owner was ZPIF "GOROD INVEST." The second owner with a share of 1% is Velna LLC, established in July 2021. The latter belongs to the same Mr. Te. This somersault looks like an attempt to blur the interests of a potential investor and prepare for the sale of a stake. After all, as you know, the beneficiaries are not disclosed in the closed-end investment fund.

Photo: rusprofile.ru

Prenter LLC itself was established in November 2022 as a developer-contractor and looks like an "alternate airfield," since revenue for 2023 was zero.

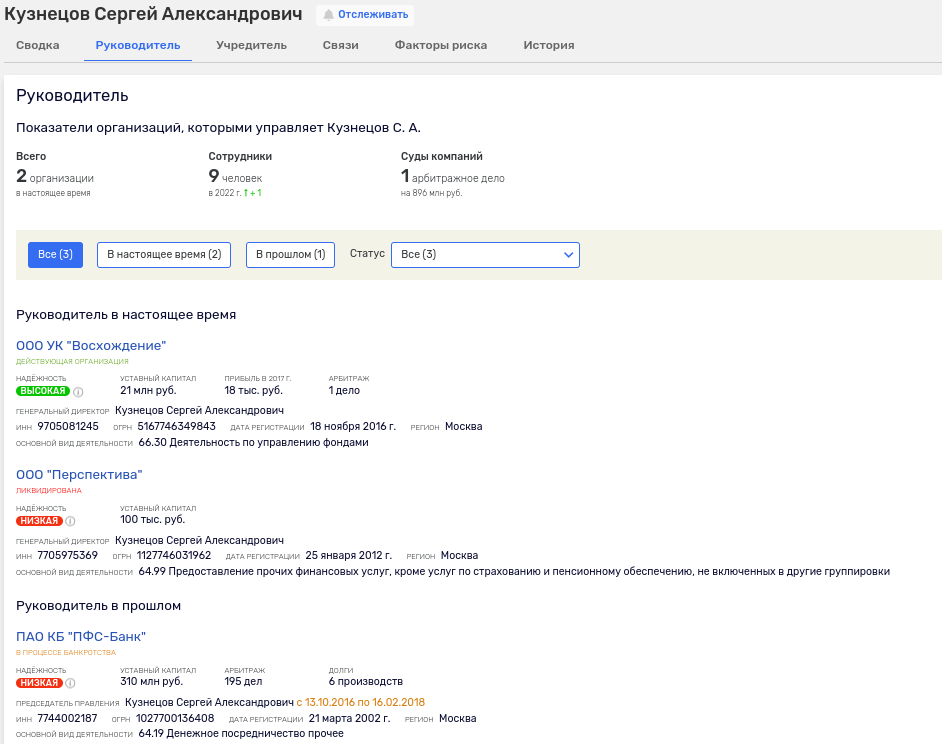

ZPIF-om, to which the company was transferred, is managed by LLC UK "Climbing." The management company is 51.3% owned by Sergei Kuznetsov, the former head of the board of PJSC CB PFS-Bank.

The bank burst, having lost its license, in 2020 and is currently in bankruptcy. Later, a "hole" in the capital for 71 million rubles was found in it. In 2014, the bank's top managers Oleg Lukyanychev and Viktor Lavrikov were suspected of fraud and involvement in the theft of 361 million rubles from shareholders, causing damage to the bank by 1.2 billion rubles.

Photo: rusprofile.ru

Offshore footprint for Prenter

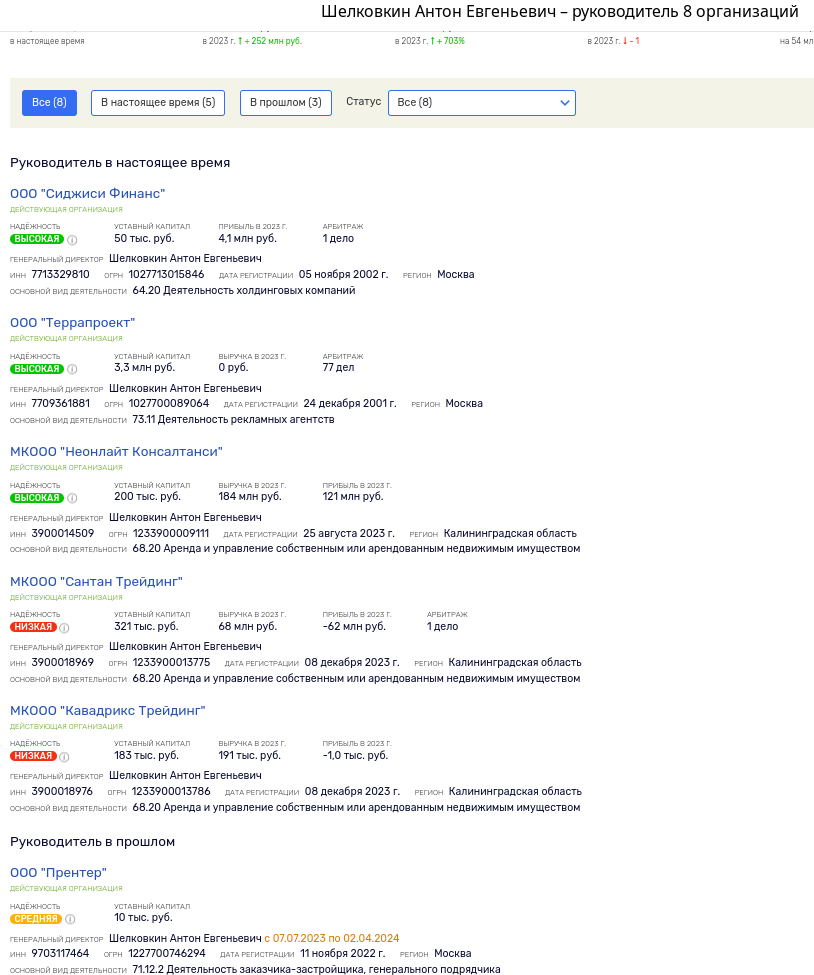

An interesting fact: at one time the Prenter company was headed by Anton Shelkovkin. He also acted as director of a number of Te firms, including companies transformed from Cypriot offshore companies with a residence permit in Kaliningrad - MCLOO Neonlight Consulting, MCLOO Santan Trading and MCLOO Kavadrix Trading. All these and a number of other former offshore companies are associated with Te.

Earlier, The Moscow Post reported on the offshore chain associated with Sobyanin's developer, specifying that together with the Kavadrix Trading ICLF and the Watermidow Trading ICLF, the Selkon Holdings ICLF was created at the same address.

Since 2000, Kavadrix has been operating in Cyprus as KAVADRIX TRADING&INVESTMENTS LIMITED, having a representative office in Moscow at the address of IFC Capital City, which was built by Capital Group.

Photo: rusprofile.ru

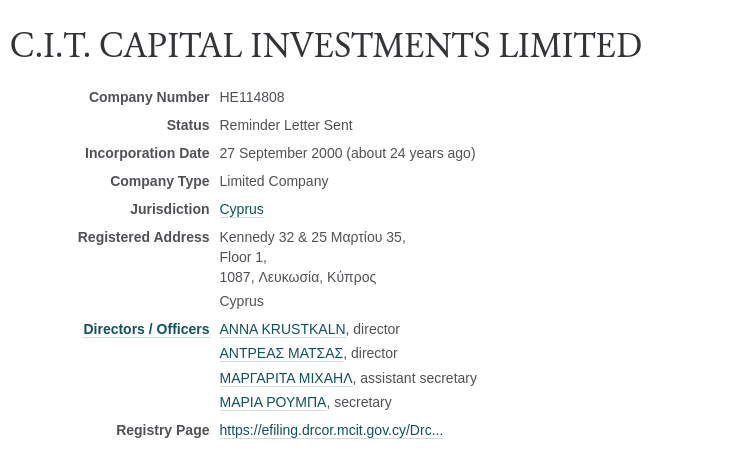

The company "Watermidow Trading" (former offshore - WATERMEADOW TRADING&INVESTMENTS LIMITED) to this day belongs to the Cypriot "Si. ay. ti. Capital Investments Limited "and its representative office are located in the same" City of Capitals. "

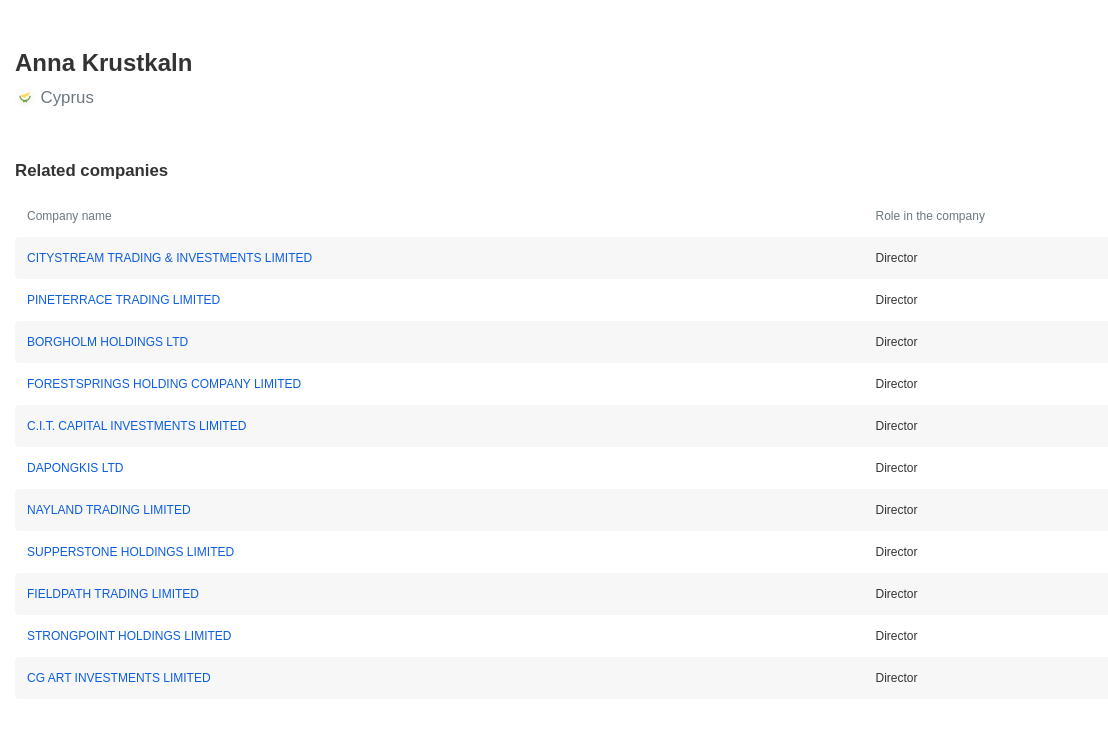

This offshore company is operating and its director is ANNA KRUSTKALN, which acts as a director of 11 more Cypriot companies, including SUPPERSTONE HOLDINGS LIMITED. The latter appears as the founder of a number of companies. The list also includes the above firms associated with the Te division.

Photo: opencorporates.com

Photo: b2bhint.com

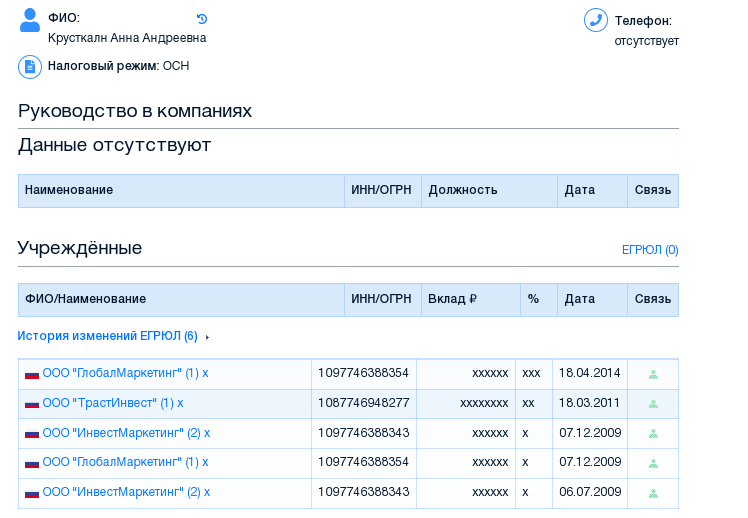

But the most important thing is that a certain Anna Krustkaln was previously the director of InvestMarketing LLC, which until March 2024 belonged to Mr. Te. This hints that the above pack of offshore companies may be related to the capital's developer.

Photo: kartoteka.ru

Photo: rusprofile.ru

Thus, we observe a certain bunch of Prenter LLC with a whole pack of offshore companies and former offshore companies "re-signed" in Kaliningrad. But this still does not reveal why it was necessary to hide the seemingly "dummy" - the Prenter company for such a structure as a closed-end investment fund?

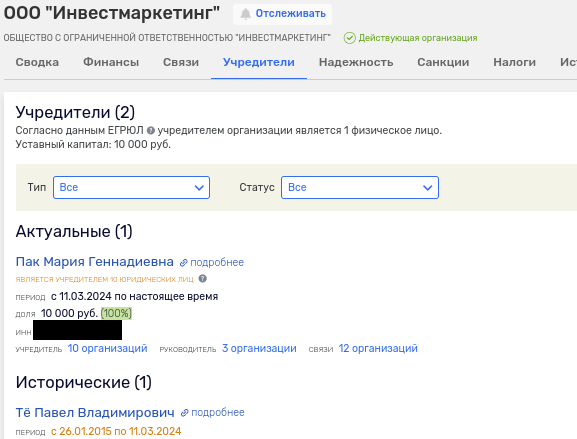

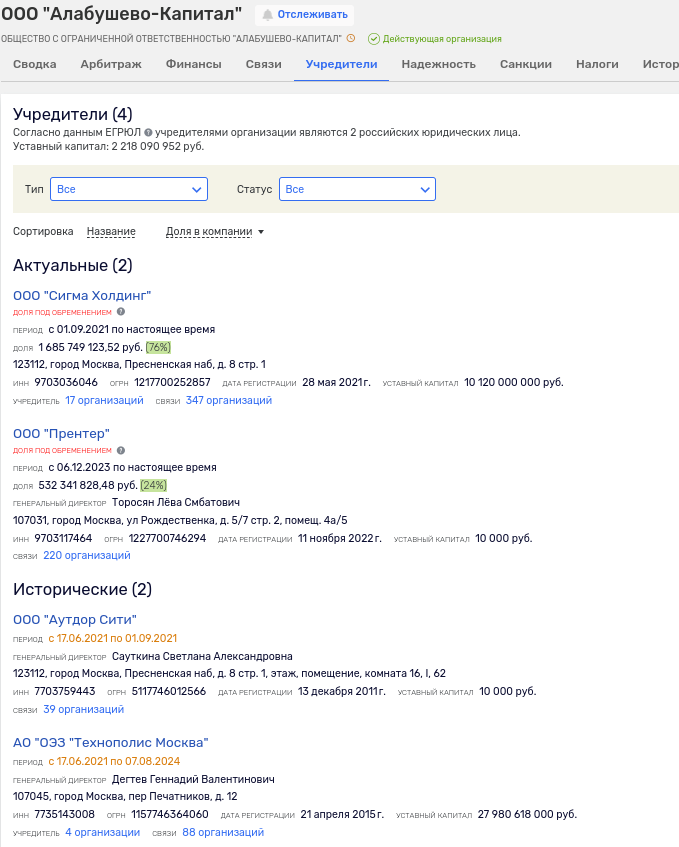

The answer to this question is most likely hidden in the "daughter" of Prenter LLC - Alabushevo-Capital LLC (24% of the share). 2.2 billion rubles were pumped into the authorized capital of the latter.

In August 2024, the government-owned SEZ Technopolis Moscow left the Alabushevo-Capital project. The remaining share in the company belongs to Sigma Holding LLC, which is owned by Pavel's son Tyo German (through Ganymede Consult LLC) and Sergey Gordeev's PIK group (through Pik-Investproekt LLC).

Gordeev is a longtime hero of investigations, no less than Te who loves foreign money boxes.

By the way, it is not superfluous to recall that Te owns several apartments in Paris through the French company Brachium together with his wife Olga Karput-Te. The property was bought on a mortgage taken from a foreign bank.

Photo: rusprofile.ru

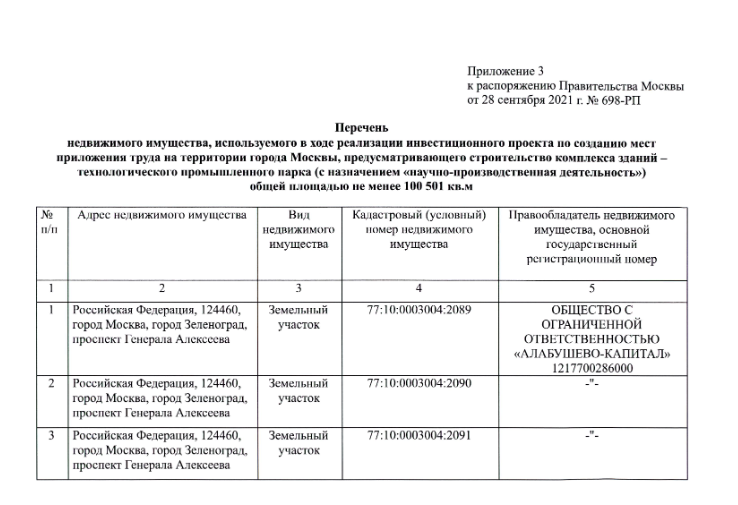

It is also interesting that the shares in Alabushevo-Capital are pledged in the bank of German Gref. Probably, Sberbank will finance a large-scale project of the company. Indeed, in 2021, Sergei Sobyanin issued an order regarding a large investment project for the development of the territory annexed to the Alabushevo industrial zone.

It was a project providing for the construction of a complex of buildings of a technological industrial park (with the purpose of "research and production activities"). The Alabushevo-Capital company appeared in the document as the copyright holder of three sites in Zelenograd, where part of the project will be implemented.

Photo: mos.ru

The investment project will receive very good support from the authorities, including a 6-year deferral and rental benefits for housing plots in other areas. Tempting jackpot.

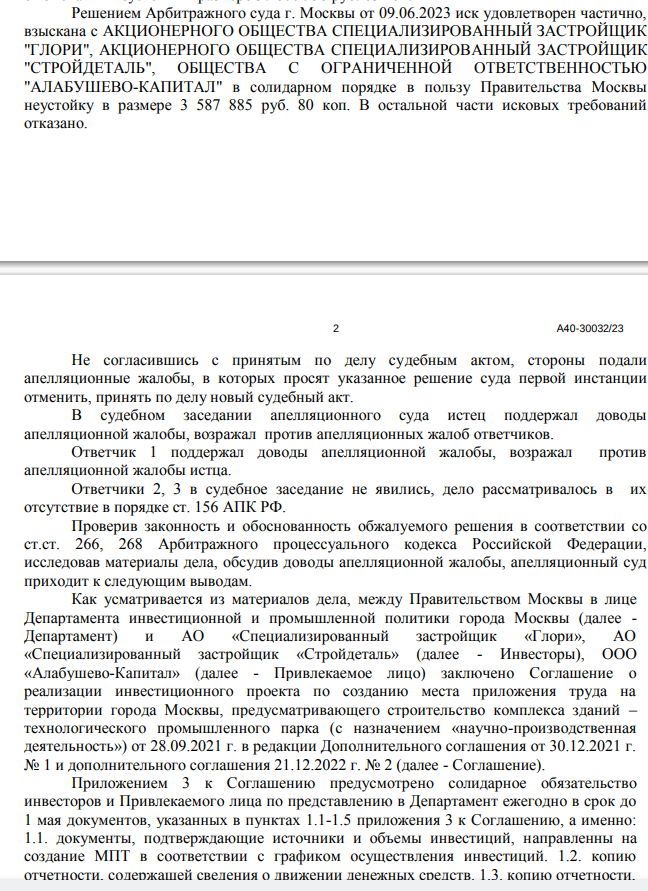

By the way, in 2023 Alabushevo-Capital acted as a co-defendant in the lawsuit of the Moscow government. They tried to recover 37.8 million rubles from the participants of the investment project for non-fulfillment of a number of obligations prescribed in the agreement. At first, the claim was partially satisfied, but in the second instance the verdict was canceled.

Photo: kad.arbitr.ru

Thus, the transfer under the closed-end investment fund Prenter LLC looks like an attempt to soak a possible buyer of a stake in the Alabushevo project. Te quite often practices the scheme of resale of shares in firms participating in large investment projects. So, for example, he introduces regional firms to the market that have previously tarnished their reputation on the ground, or cooks a jackpot on the banal resale of part of the project, which was approved by the Sobyanin government. No wonder the developer in narrow circles was given the nickname "Reseller Sobyanin."

.jpg?v1727929739)

.jpg?v1727929739)