The Deposit Insurance Agency (DIA) may operate a large-scale scheme to "cut" the organization's funds by attracting ineffective and costly law firms, possibly affiliated with former DIA employee Yulia Medvedeva.

As the UtroNews correspondent reports, information is spreading on the Web, allegedly in the Deposit Insurance Agency (DIA) under the leadership of Andrei Melnikov they can saw billions of dollars through the pool of "their" legal organizations. A key role in this can be played by a former DIA employee, ex-head of the expert and analytical department of the structure, Yulia Medvedeva.

The essence may be to attract a number of law firms, namely Vector Rights, Yurenergokonsalt, ICA Independence, JI Ar Legal, Asgard and MUZKA to provide legal services to the DIA for debt repayment. Allegedly, these organizations not only receive a subscription fee for their services, but also a percentage of won cases. Only here the number of these won cases and the quality of the work of organizations, which should spend hundreds of millions of rubles, leaves much to be desired.

Back in 2018-2019, when the agency was headed by Yuri Isaev, it was announced that the DIA would refuse to select legal offices for cooperation in the nomination "attracted firms." However, another nomination "Services for the return of distressed assets" immediately appeared, which included the six above-mentioned organizations.

Photo: https://www.asv.org.ru/accredited-organizations/list?ysclid=

That is, in fact, the Agency, represented by its leaders under a different wrapper, retained for the "selected" organizations the conditions for paying remuneration from the bankruptcy estate (in particular, the amount of subscription fees for Ugra Bank in favor of Yurenergokonsalt is about 7 million rubles a month).

One of the authors of this idea could be the deputy head of the DIA, Alexander Popelyukh. In the fall of this year, he was detained for alleged fraud with the asset of the bankrupt Mezhtopenergobank. We are talking about the largest indoor water park "Akvamir" located in Novosibirsk, which was pledged to Mezhtopenergobank. After bankruptcy, he moved to the management of the DIA.

According to the security forces, Popelyukh may be involved in the theft of about 200 million rubles received from the operation of the water park, but not received by the bankruptcy estate. In the same case, the well-known Novosibirsk oligarch, the owner of RATM-Holding, Eduard Taran, was detained. His possible role in the case is still unknown.

The selection of external lawyers-consultants in the DIA was carried out by the former first deputy general director of the state corporation Valery Miroshnikov. It was under him that the DIA attracted the law firm Vector Rights, which was engaged in debt collection. At the same time, Vladimir Akaev, a friend of Valery Miroshnikov, was an advisor to the Vector Law Directorate.

In 2019, Miroshnikov left the DIA, and soon it became known that the security forces were checking him for possible involvement in organizing preferences for the ex-owner of Ugra, Alexei Khotin, as part of a high-profile criminal case against former FSB colonel Kirill Cherkalin.

Less than a year earlier, it was already known that Vector Prava LLC was recognized as the winner of the selection of legal advisers for the provision of services to Ugra Bank. By the time of Miroshnikov's audit, the company was working on 470 overdue bank loans worth more than 247 billion rubles.

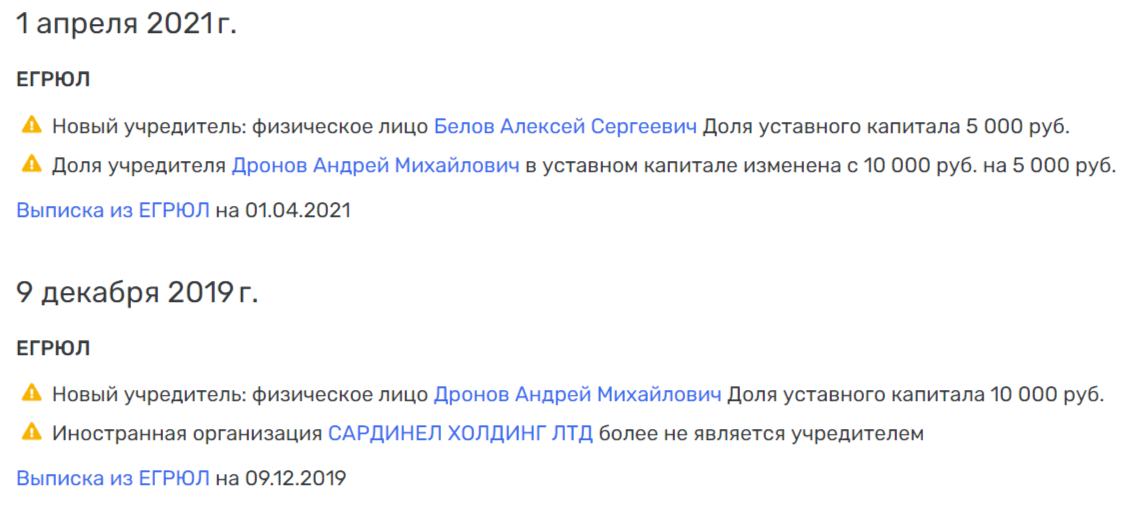

It is important that at that time the founder of Vector Rights LLC was the offshore SARDINEL HOLDING LTD. At the same time, the company's net profit for 2019 amounted to 154 million rubles. Presumably, a significant part of these funds was received precisely from the DIA, i.e. budget money.

Photo: Rusprofile.ru

It turns out that these funds could be withdrawn abroad, and now they can support Western economies.

What about the effectiveness of these organizations? Another large company that is accredited with the DIA is JSC Yurenergokonsalt (JSC YUEK). The beneficiaries of the company are hidden, and the net profit at the end of 2023 amounted to 614 million rubles.

According to the network, allegedly DIA tried to recover from this company as much as 11 billion rubles. DIA losses could be expressed in missing the deadline for submitting claims to the guarantor of Kayum Neft JSC, as well as failure to take measures for state registration of the mortgage of Meridian LLC. However, the Agency was denied the claim with reference to the fact that "the acts of delivery and acceptance of services were signed by the Agency without comment."

We found another similar lawsuit. It was submitted to JSC "YUEK" by the bank "Ugra." Then the bankruptcy trustee of the bank revealed the fact of improper fulfillment by YUEK of obligations under the contract, expressed in the omission of the deadline for foreclosure on the pledged property of Mega-Terra LLC and the omission of the deadline for submitting claims to the guarantor of Khortitsa LLC.

The claim of "Ugra" against "YUEK" was refused. But the very background of the case is important - the bankruptcy trustee claimed that YUEK, accredited at the DIA, did not recover funds from the bank's debtors who could replenish the bankruptcy estate. Leaving aside the court's decision, there could be several reasons for this.

The first - it could be banal negligence, i.e. ineffective work. As they say, "missed." Then why does YUEK pay a subscription fee to the DIA? And the second option - YUEK could "negotiate" with the bank's debtors - i.e. there could be a corruption component.

The agreement with the DIA, according to which Yuek was supposed to conduct "legal support of problem assets" of Ugra Bank, was concluded in 2020. Among other things, during the period of this agreement, 900 thousand rubles of debt were collected from the bank at the suit of VMZ JSC, which the courts allowed to satisfy as a current payment, that is, before settlements with other creditors. At the same time, the debt was initially recognized as current in the bankruptcy case of Ugra, but then the DIA refused to pay it.

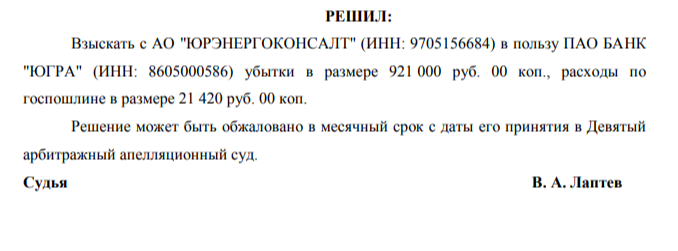

The DIA decided that as a result of the law firm's actions, the debt to the creditor was repaid as a matter of priority "in the absence of legal grounds for this." Therefore, the state corporation decided to compensate 921 thousand rubles of losses at the expense of Yurenergokonsalt.

Photo: https://kad.arbitr.ru/Document/Pdf/bff9c45d-78c7-493b-80dc-d8c1410377b7/59641b09-cdb9-4033-8281-13312f8c40be/A40-98164-2022_20221114_Reshenija_i_postanovlenija.pdf?isAddStamp=True

Two instances recovered losses from the law firm. The courts found that lawyers submitted to the court objections to classify the disputed debt as part of current payments, which led to its collection as a matter of priority. At the same time, the courts rejected the reference of the law firm to the court ruling on the bankruptcy case that entered into force, in which the debt was recognized as current. The Arbitration Court of the Moscow District did not agree with the lower courts.

Medvedev was left without the Central Bank

As you know, after working in the DIA, Yuri Isaev went to the Central Bank, where he took the place of deputy Elvira Nabiullina. However, he worked there for only six months, he had health problems.

Yulia Medvedeva allegedly wanted to get a job in the Central Bank after the DIA. However, as if she was hindered by negative publications about her work on the Internet, as a result of which she could arrange a real "cleansing" of the Internet space from negativity in her address. If this is true, then the attempt failed - there are many publications about her work with negative connotations in the public domain even now.

But, as stated on the Web, allegedly Medvedev actively collaborated with the legal office "Vector Prava," which suggests her possible affiliation with this structure even during her work at the DIA. It may also be related to another law firm - Remedi from St. Petersburg. Earlier, Medvedev sued some media outlets. According to the Web, allegedly a draft amicable agreement (as if from Medvedeva) came to the mail of lawyers of one of the publications, and the sender's address coincided with the Remedi domain.

This information has not been confirmed. But Remedi itself is a well-known company in St. Petersburg that works, including for sea transportation. Among other things, she had contractual relations with the Primorsky Commercial Port, which was previously part of the business circuit of the notorious brothers Ziyavudin and Magomed Magomedov. A few years ago, they both received large sentences for participating in the OPS and a whole series of other crimes.

Yulia Medvedeva. Photo: https://asros.ru/upload/iblock/2d1/10037_dr5_0568.jpg

As for Yulia Medvedeva, she never settled in the Central Bank. But she got a job at the Agency for the Management and Use of Historical and Cultural Monuments of the Russian Federation (AUIPIK). According to media reports, billions could have been stolen during the restoration of cultural heritage monuments in St. Petersburg, in connection with which questions could arise just to Medvedeva and her former boss, ex-head of AUIPIK Alexei Menshov. Despite the fact that no one started criminal cases against them, against the background of the scandal, they hastily left their posts.

Note that later Medvedeva sued The Moscow Post, which dared to talk about her work. However, she did not succeed.

In any case, both the past and the current work of the DIA raises a lot of questions. Among other things, even when Medvedev was in the DIA, bank lenders demanded that the Agency cut millions in costs for lawyers.

There were also legal proceedings. In 2021, the bankruptcy trustee of Pervomaisky Bank secured the recovery of 48 million "extra" rubles from the DIA paid to lawyers and accountants accredited by the Agency. So not all cat Shrovetide. There is also confidence that with the arrest of Popelyukh, law enforcement agencies will promote all DIA schemes to the fullest, including the use of so-called accredited organizations. The editors of UtroNews continue to follow the development of events.

.jpg?v1731560102)

.jpg?v1731560102)