In the case of the collapse of the Hydrometallurgical Plant of Stavropol, the beneficiary of which Albert Avdolyan was recognized, a new round of comedy began. Now the oligarch's squires are trying to knock out the creditors, who once pulled Chemezov's protégé by the ears, proving that he is the beneficiary.

Having lost control over the GMZ and the associated Southern Energy Company (YUEK), Avdolyan's squires jumped to court, where they sometimes look like heroes of jokes.

The UtroNews correspondent understood the situation.

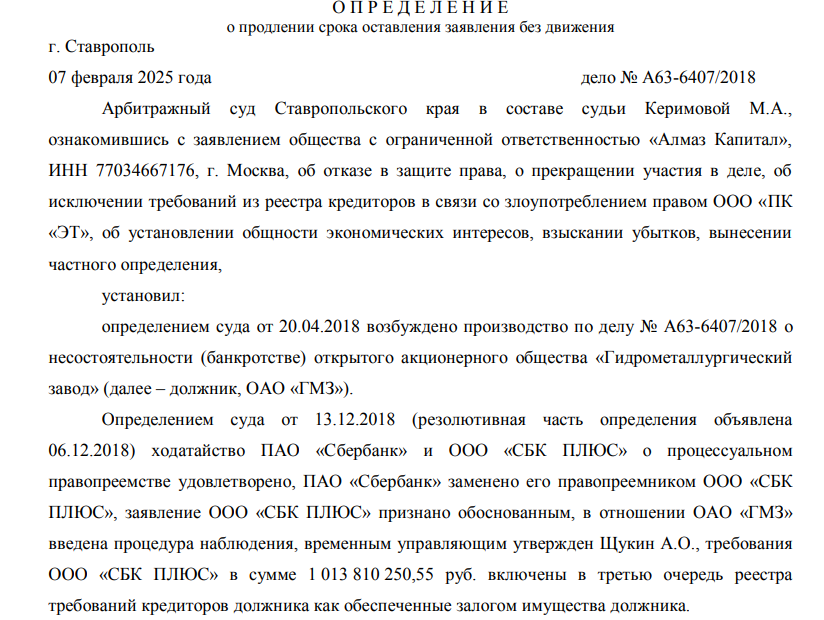

This time Almaz Capital LLC is trying to exclude from the list of creditors, that is, those who have the right to vote when dividing assets, PK ET LLC. At the same time, the Avdolyanovskaya team demands to recover a certain loss from PK ET LLC for allegedly delaying the bankruptcy of the GMZ. Otherwise, do you want to steal the remains of liquid property?

The applicant did not attach any justification for his impudence on the basis of the law, and not just "I want it so," and the court gave time to eliminate the shortcomings. They did not eliminate them on time and left the application motionless again, now until 14.03.2025.

Photo: ras.arbitr.ru

Photo: ras.arbitr.ru

Also, Almaz Capital LLC was required to bring the requirements in terms of the obligation of the bankruptcy trustee of OJSC GMZ to exclude the requirements of PK ET LLC from the register of claims of creditors of OJSC GMZ in accordance with the current norms of the Bankruptcy Law. Wishlist alone is not enough.

Such behavior of Almaz Capital LLC is most likely due to the fact that the lender objectionable to them is associated with the team that once opened all the ambiguous transactions of Avdolyan's squires and proved that he was the beneficiary.

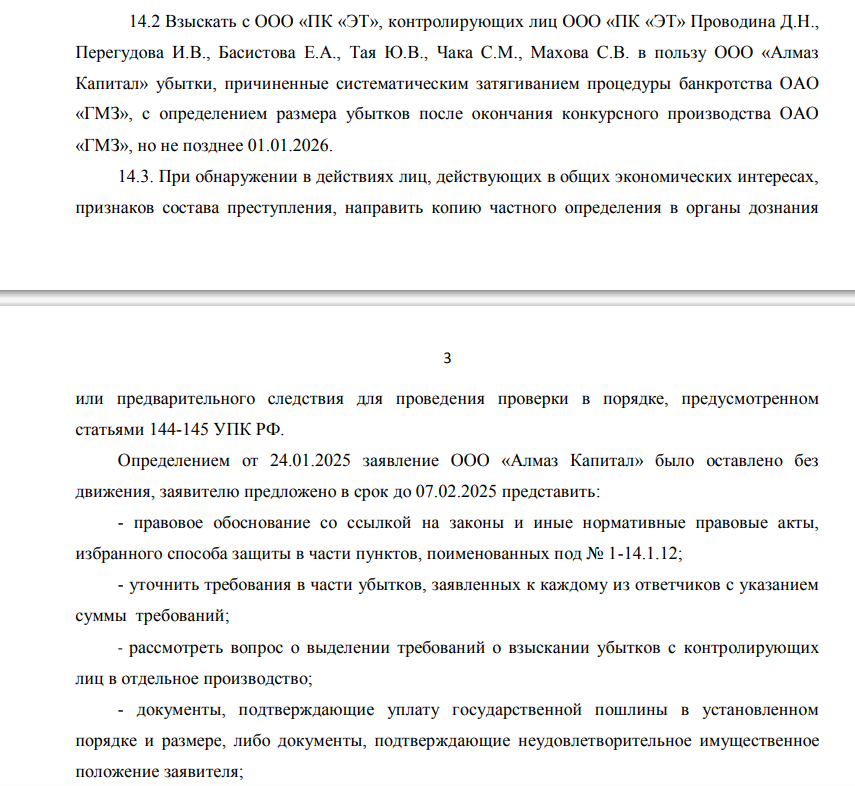

Recall that a few years ago, the shareholders of GMZ and all related firms Sergey Makhov and Sergey Chuck, having collected loans from Sberbank, brought the assets to the handle. Later it turns out that the loan money for the modernization of the enterprise did not go, but were merged into the unknown. Debts grew and at some point dragged the strategic asset to the bottom. Then in 2018, these two comrades merged GMZ and YUEK for a penny to Albert Avdolyan's proxies. Officially, the shares were sold for the following amounts: GMZ was sold to Enigma LLC, which is currently in bankruptcy, for 3.8 thousand rubles, and UEC shares for 5 thousand rubles to Andrey Korobov.

Photo: ras.arbitr.ru

Korobov is not only the director of Avdolyanovsky PJSC YATEK, but also a native of Rostec state corporation, whose head Sergei Chemezov is very close to Avdolyan.

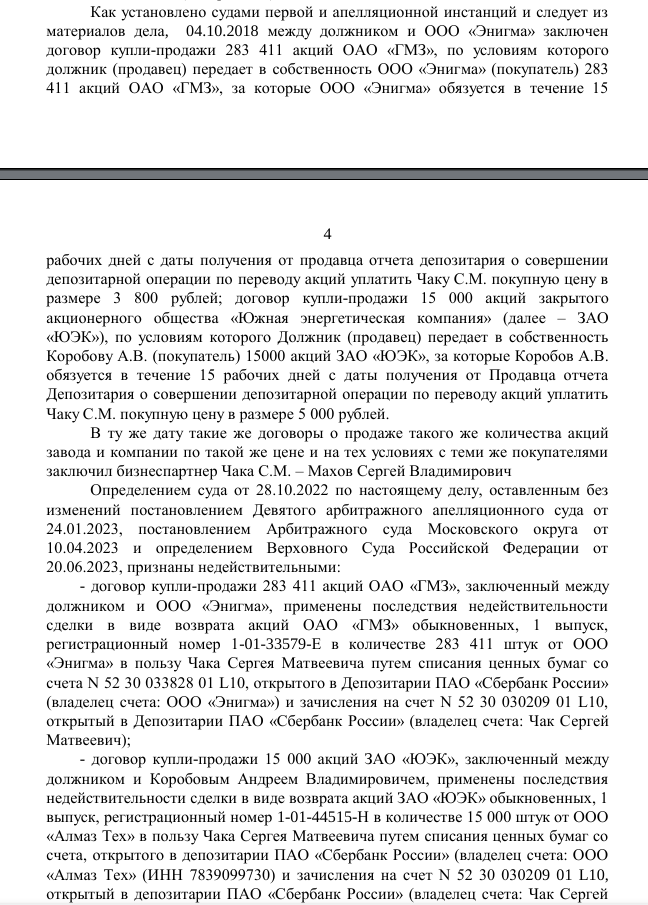

Chemezov and his wife are members of the board of trustees of Avdolyan's New House Foundation, and Rostec himself has repeatedly crossed paths with the oligarch's assets as a co-owner. For example, in OOO Port Vera Holding and OOO Port Vera Management, a subsidiary of the state corporation, OOO RT - GR, inherited.

And besides Korobov, a native of the same state corporation, Rodion Treasure, has long and densely settled in Avdolyan's division.

Photo: rusprofile.ru

But back to the GMZ and its problems.

Simultaneously with shares in assets, another group of people close to Avdolyan in the same period redeems the right to claim debt from the same companies (GMZ and YUEK). But the debts are being held until the sale and purchase of shares was challenged in court and the oligarch's squires lost control.

It was then that the debt came out, which they tried to hang on the YUEK, slipping the draft settlement agreement to the judge. By that time, thanks, among other things, to the aforementioned creditor from the opposing group, it was revealed that Avdolyan was not only the beneficiary of the shares, but also of the debt. It also surfaced that the draft settlement agreement, according to which they tried to hang a billion rubles of debt on YUEK, was not agreed by the board of directors. It was untenable by that time.

As a result, today, in the framework of the bankruptcy case, the GMZ in court is trying to challenge a whole pack of transactions promoted by the oligarch's team. Among them - the transfer of funds within the framework of the tolling agreement to the accounts of Cashmir Capital LLC. It is also associated with the same Avdolyan.

Under the agreement of 2018, that is, since the year of the purchase of GMZ and YUEK, more than 9 billion rubles have been spent on the accounts of the LLC from GMZ. Today, the issue of the legality of this agreement is being considered. In the summer of 2024, the Ministry of Industry and Trade of the Russian Federation and the Federal Tax Service at the meeting admitted that the LLC made a profit of 2.3 billion rubles and caused damage to the enterprise with this ambiguous joint activity.

In addition, at different times, hundreds of millions of rubles were withdrawn to the accounts of affiliated firms, and part of the property went into other hands as compensation.

It was Almaz Capital LLC, from which we began our story, that at one time tried to rip off 1.2 billion rubles under a guarantee agreement with YUEK.

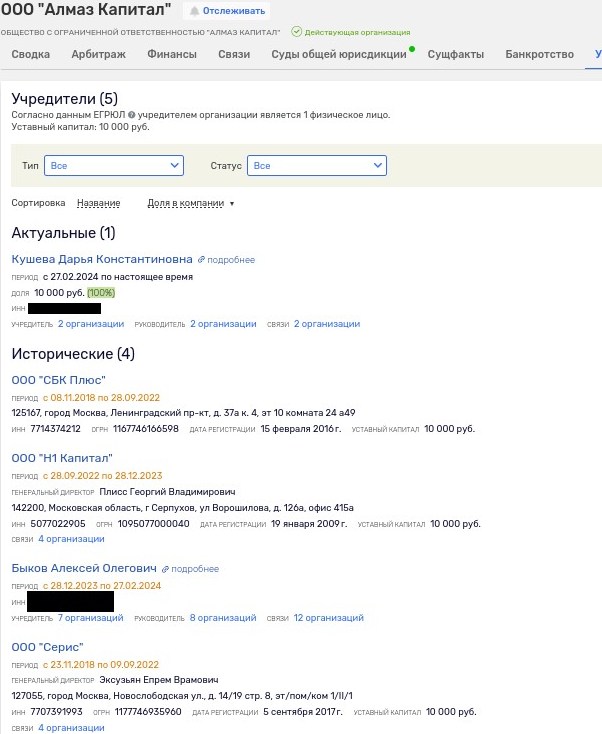

In 2024, Almaz Capital LLC, in order to apparently not shine much with affiliation, changed the owner to the unknown Daria Kusheva, who in May 2024 also transferred another affiliated asset - Almaz Innovation.

Before her, the company wandered from hand to hand: from SBK Plus LLC to a certain N1 Capital LLC Alexander Oseikin, and then to Seris LLC and Alexei Bykov.

Bykov is directly related to AENP LLC (now called N.A. Popov CIPE LLC), which tried to enter the register of creditors of the bursting energy holding MRSEN.

The beneficiary of MRSEN was a relative of Avdolyan, and now the person involved in the criminal case on the withdrawal of 10 billion rubles from Russia, Eldar Osmanov. Firms affiliated with Avdolyan, in the MRSEN case, tried to get in as creditors of the holding's legal entities, trying to snatch at least a piece of wool from a sinking asset of relatives.

Photo: rusprofile.ru

Today, the Enigma company, which bought shares at an invoice price from a not very expensive restaurant, at the suggestion of financial manager Sergei Chuck, became the defendant in the bankruptcy case. As interim measures, it was seized for 690.555 million rubles in the accounts of controlling persons, including Avdolyan. He could not challenge the arrest.

The bankruptcy case of Enigma can also reveal the entire oligarch's cover-up, since there are already requirements for the provision of contracts with BBR Bank JSC. And that this bank, that its shareholder Dmitry Gordovich has already been mentioned more than once in investigations, including those related to Avdolyan's offshores, the transfer of 100 million rubles to the Latvian bank - JSC Citadele Banka, and Gordovich also appeared in the collapse of the MRSEN energy holding.

Photo: ras.arbitr.ru

The situation around pulling to the bottom of the GMZ has already overgrown with so many dubious episodes that the criminal case suggests itself. At the same time, the courts have already identified even the beneficiaries of most of them.

But the main person involved seems to have too weighty a lobby behind his back, because he was convinced of his caste impunity, turning through proxies the story of the collapse of a strategic asset into an anecdote...

.jpg?v1740374303)

.jpg?v1740374303)