Vladimir Potanin will help Igor Sechin defeat Vagit Alekperov's Lukoil?

President Vladimir Putin signed a decree allowing Rosbank Vladimir Potanin to buy out the shares of French investors Societe Generale in Russian companies. Among others, the oligarch will get Rosneft shares, and at a price clearly below the market price.

At the same time, Potanin has a major project with Vagit Alekperov's Lukoil. Earlier, the head of Rosneft, Igor Sechin, had already tried to crush Lukoil for himself. The entry of the owner of Norilsk Nickel into Rosneft may lead to conflicts, and, as a result, a new configuration of forces in the oil market.

Details - in the material of the correspondent of The Moscow Post.

Half a country for a penny

It is amazing how Vladimir Potanin manages to receive myriad wealth for a penny. At one time, he received Norilsk Nickel for nothing. But it was Vladimir Olegovich who in 1995, together with a group of other bankers, offered the state loans secured by shares of state-owned enterprises. And he also took up the implementation of this proposal already in the rank of Deputy Prime Minister of the Government of the Russian Federation.

The auctions were held, and on September 1, 1996, the pledge of shares received by banks expired. Huge state assets were in the hands of Potanin and people as visionary as himself.

One of the most active creditors of his native state was ONEXIM Bank, which the oligarch founded with another future billionaire Mikhail Prokhorov. The award to him was 51% of the shares of Norilsk Nickel from the very first collateral auction (initially Potanin received only 38%). It cost only $170 million - an absolutely ridiculous amount for such a giant.

Norilsk Nickel was not the only major asset that "sailed" to through collateral auctions. For this penny, he managed to buy 51% of the oil company JSC SIDANKO, 20% of OJSC Novorossiysk Shipping Company, 14.8% of the Novolipetsk Metallurgical Plant, as well as OJSC North-Western Shipping Company. In the summer of 1996, structures controlled by the oligarch acquired a stake in Svyazinvest.

At the same time, Surgutneftegaz, Lukoil and many other companies were privatized, whose shares will now go to Vladimir Potanin's Rosbank for nothing. Recall that he bought this bank at an extremely modest price from the same French from Societe Generale. But it is precisely these assets that Igor Sechin probably dreams of, who is credited with the desire to consolidate the entire oil sector of the country under the control of Rosneft.

Vladimir Potanin received huge assets for a penny. Photo: https://cdnn1.inosmi.ru/img/15855/86/158558620_0:0:0:0_1240x0_80_0_0_e8aa1cac51cd645b887e689dc6677247.jpg

At an extremely modest price, Vladimir Potanin should have got other assets of foreign companies leaving the country. In 2022, he bought Tinkoff Bank, and, according to rumors, also for a penny. All this allowed him to lead the Forbes rating of new owners of assets of foreign companies in the Russian Federation.

At the same time, Vladimir Potanin is an extremely conflicted figure, and this conflict could already interfere with the development of the domestic economy. It is known his confrontation with Oleg Deripaska about shares in Norilsk Nickel, which has been going on for more than 10 years. Last year, Rusal Deripaska rolled out a new lawsuit to Potanin: allegedly, his actions could harm Norilsk Nickel, and, as a result, affect the amount of dividends for minority shareholders.

Conflict with Alekperov

There is no doubt that they will continue to "butt." But now Potanin has a new field for the game, which he will try to use to his advantage - the tense relations between Igor Sechin and Vagit Alekperov.

With Lukoil, Norilsk Nickel has a joint venture Vareineftegaz (VNG LLC), where each holding has 50%. The company forms a large oil and gas sector in the Yamalo-Nenets Autonomous Okrug - 68 million tons of oil and 323 billion cubic meters of gas are expected to be produced. Both oligarchs clearly do not intend to abandon such a project, which may come in opposition to the interests of Rosneft.

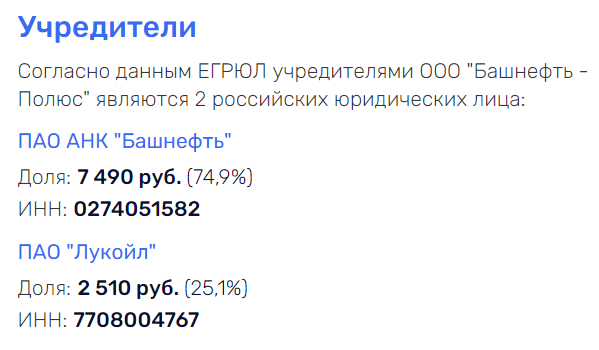

At the same time, Rosneft and Lukoil also have a joint venture - Bashneft-Polyus (74.9% and 25.1% of shares, respectively). It operates at the Trebs and Titov fields, and oil is exported through the Varandey Arctic terminal.

Photo: Rusprofile.ru

Bashneft received a license for the Trebs and Titov field in 2011 and transferred it to Bashneft-Pole. A little later, 25.1% of this company was bought by Lukoil, which owns the necessary infrastructure for the development of the field.

In 2012, Bashneft minority shareholder Svetlana Proskuryakova challenged the transfer of rights to develop Bashneft-Polyus. She could act in the interests of the company led by Igor Sechin.

Rosneft does not need competitors

There were rumors that it was Sechin who could be behind Bashneft's "push-up" and the elimination of Yevtushenkov's oil ambitions. The asset was received by Rosneft, while it immediately filed a lawsuit against Sistema for 131 billion rubles, demanding the return of dividends sent from Bashneft in 2009-2014. Allegedly, the money was withdrawn from the company illegally. As a result, the court sided with Rosneft.

Perhaps Sechin's ambitions are to collect under the control of Rosneft all the producing and at the same time transporting capacities of the country's oil industry. Numerous conflicts between Rosneft and Transneft are known, for example, when both companies accused each other of polluting the Druzhba pipeline.

At one time, the tense relations between Sechin and Tokarev could prevent Rosneft from eliminating Lukoil from the Bashneft-Polyus logistics chain. Allegedly, Sechin lobbied for the option of building a pipe from Varandey to the port of Indiga on the Barents Sea so that Lukoil's infrastructure would not need to be used. Only now the construction was supposed to go to the funds of Transneft, with which Tokarev did not agree.

After Vladimir Yevtushenkov left the stage, Rosneft began to actively conflict with Lukoil at Bashneft-Polyus. In 2018, the state corporation sought to reduce the tariff for transshipment of oil through Lukoil Varandey from $38 almost three times. The cost set by Alekperov's company was called monopoly high by Sechin.

Potanin mutates water

What could Sechin's interest be? Take it for yourself and correctly distribute it? Recall that Bashneft at one time tried to buy the ex-general director of Rosneft Eduard Khudainatov, who is considered a person close to Sechin, but then Yevtushenkov opposed this.

Moreover, Sechin also has a personal interest - after all, he himself is a shareholder of Rosneft. By 2014, its share exceeded 1.2%, which at that time could cost about 3 billion rubles. Only, it seems, Sechin began to confuse his pocket with the state, directing 35% of net profit to pay dividends to management and top managers. That is, including myself. But this is not a private shop, but a state strategic asset.

Igor Sechin. Photo: https://yk-resurs.ru/wp-content/uploads/5/b/c/5bcef24361251d110b2499c81320a429.jpeg

An increase in Potanin's share in Rosneft through Rosbank is unlikely to please Igor Sechin. And Potanin's love for corporate conflicts risks complicating Rosneft's already tense relations with Lukoil. And while rich and influential people will share the country's oil industry, the Russian economy may unwittingly suffer.

Read more: http://www.moscow-post.com/economics/neftyanoy-vopros-ih-isportil-sechin-potanin-alekperov-188477

.jpg?v1703654467)

.jpg?v1703654467)