The detention of the former top manager of Derzhava Bank Timur Nazyrov will lead to its head Sergei Entts?

Former deputy chairman of the board of AKB Derzhava Timur Nazyrov has been put on the wanted list, TASS reports. He is accused of large-scale fraud. Official sources have not yet given other details.

Maybe related to the withdrawal of money from the "Power"? Details - in the material of The Moscow Post.

100 million for the tall man and the other side of Entz

Bank "Derzhava" and its head Sergey Entts specifically among the journalists of our publication are associated with excessive appetites and the ability to see what is not. We are talking, of course, about a lawsuit for 100 million rubles, which the Power controlled by him filed with The Moscow Post because of the article "Sovereign thimble bankers."

The funny thing is that this material is, in fact, a fairy tale about how bankers can steal from gullible customers. The main characters of this story are "Bunnies," "Toads" and "Jackals." Interestingly, the representatives of the plaintiff were not ashamed to ask an independent publication for 100 million rubles for a tall story?

Such antics further draw attention to the bank and its first persons. We also recall that "Power" and Entz, despite all their "whiteness and fluffiness," are involved in a huge number of impartial stories.

Even the state VGTRK published a report (which can now be found on YouTube under the name "Clients of the capital's bank risk staying on the street"), which said that the bank resold the civilian apartments pledged from it on loans to another legal entity, otherwise it simply let them under the hammer, leaving dozens of families homeless.

It was yours - it became ours. Honestly, it resembles some kind of scheme from the 90s, and by no means the actions of an honest bank. Moreover, the whole story has not yet been completed - as recently as in April last year, a pensioner contacted The Moscow Post, who suffered from the actions of the bank and still cannot return the living space.

At the same time, we received interesting details - according to the information provided to us, loans are allegedly resold even before the conclusion of contracts, and the persons who redeem these loans are affiliated with Mr. Entz. At the same time, the courts for some reason do not see this point blank...

The Tikhonov case and market manipulation

But not single apartments. There was also a scandal in the "repertoire" of "The Powers," on an all-Russian scale, larger - this bank appeared in history, which led to a resonant criminal case against the already former Deputy Minister of Energy Anatoly Tikhonov, which, by the way, still stretches and concerns theft on the system of collecting and processing information GIS TEK.

The role of "Power" here is as follows - it acted as a guarantor of the fulfillment of obligations for 24 million rubles of the company "ISSB," which was originally a contractor of GIS TEK., And subsequently was bankrupt. As The Moscow Post later found out, this could be done deliberately - in order to "earn extra money" through another contractor. What role "Power" could play in this is an open question. She, it seems, fulfilled her obligations to ISSB, but didn't some of this money go into the pockets of those interested?

Bankers have similar antics. Moreover, this may take place in this situation, since there was already something similar in the "file cabinet of the past" of the "Power." We are talking about transactions with TRINFICO Holdings JSC in 2019 - later the Bank of Russia established the fact that this company was manipulated by the bond market.

In all transactions concluded during the audited period between these legal entities, significant deviations in the volume of trading were revealed, most transactions led to significant deviations in the price of securities. In the same period, the Power's assets "noticeably" strengthened "- according to Banki.ru, from March 2019 to November 2021, the institution's net assets grew by almost 135%, from 18.8 billion rubles to 44.3 billion.

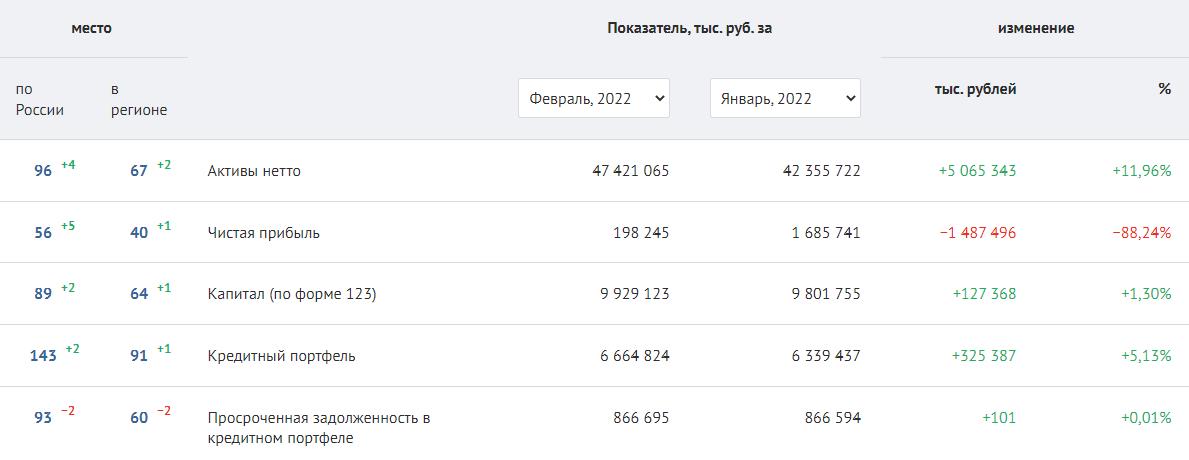

If you look at the current state of affairs, you can see that since the beginning of the year - literally in two months, the bank's profit has dropped as much as 88%! Such a picture can be observed usually in those periods when capital is actively withdrawn from institutions. Is this happening with the "Power"? And did this not cause the attention of the security forces to Timur Nazyrov?

Photo: https://www.banki.ru

Almost all indicators are normal, except for profit and - the ratio of instant liquidity and the ratio of the bank's current liquidity. The first regulates the risk of liquidity loss by the bank within one operating day and determines the minimum ratio of the amount of highly liquid assets of the bank to the amount of liabilities of the bank on demand accounts, the second regulates the risk of liquidity loss by the bank within 30 calendar days closest to the date of calculation of the ratio and determines the minimum ratio of the amount of liquid assets of the bank to the amount of liabilities of the bank on demand accounts.

In simple words - it seems that if all depositors now go to demand their funds from the bank back, he will not be able to return them - he simply does not have them. But no, as you see it, because all the profits have gone somewhere. The question is - where?

Part of the answer can be obtained from the banking analytics service Analizbankov. For the same period - since the beginning of the year, most of the bank's assets were investments in securities. Liabilities - for about the same share - attracted third-party funds - customers and other banks. It looks like Entz thought he was a tough broker. Only with such a business model he risks not with his own money, but with the money of gullible clients.

The Moscow Post a couple of years ago drew attention to the risky model of doing business, dwelling in detail on each item listed.

Where's the money, Entz?

Nevertheless, such a large outflow of profits is unlikely to be caused solely by investments - investments, as we know, should bring profit, on the contrary. And to risk such amounts that put the bank "on the blade of a knife" - we believe, not even in the style of Entz.

Perhaps the answer is in the "web" of firms that are somehow connected with Entz. Some of them are connected, including with the disgraced Nazyrov. For example, Metrix Online LLC worked as a financial adviser. The company is registered on Entz, is engaged in the development of computer software and does not shine much anywhere. Never in the period of its existence (since 2018) paid taxes, but from somewhere increased revenue.

One gets the impression that she came from somewhere "from above." So, maybe Entz and his top managers organized a "washing" structure in this way? There is not much money in the company - only about a hundred million rubles in the amount of revenue and profit for 2021, but Entz has not one or two such offices.

Among them were those who are engaged in investments in securities. Their dynamics of financial activity also raises questions - at one point there are 200 million rubles, at the other - already zero. Perhaps the money is transferred to the personal accounts of Entz and CO and is withdrawn through the purchase of his own shares?

There may also be money from public procurement that Power receives. Photo: https://www.rusprofile.ru

In addition, money can flow offshore. Entz is directly associated with SFO Accord Finance, which is owned by him and Synergy Finance LLC. The latter, in turn, is controlled by Bogatyr Partners. And this structure is the ultimate beneficiary of the German TP NEW FRONTS GMBH.

It is worth recalling here that Entz's ex-wife Alevtina Kalashnikov lives abroad. The woman, by the way, is not easy. Previously, she was vice president and financial director of the collapsed aviation company VIM-Avia. In 2017, a criminal case was opened against Kalashnikova herself on suspicion of creating something like a financial pyramid.

After Kalashnikova fled from Russia, Entz remained "on the farm," which included a lot of expensive living space. He sued for apartments for a long time and stubbornly (it would be better to protect the property of creditors), and at that time the banker was already divorced from Kalashnikova: they say, fictitious.

So, there is reason to believe that Etnz has long and successfully withdrawn bank funds in his favor, and may intend to move closer to his ex-wife. The current sweeps of the security forces may give an impetus to accelerate this procedure. So let's let the security forces give advice - to catch a banker at the airport.

.jpg?v1678343949)

.jpg?v1678343949)