The big sale of Mosgortrans assets by Sobyanin's team continues, and again, probably, the developer Roman Timokhin is in the share. The company "Perspective Renovation Silicate," on the balance sheet of which 7.8 hectares of land for residential development, could be sold to a single participant at a penny price - 66.7 million rubles.

The asset valuation materials featured a face value of 605 million rubles, that is, on the way it suddenly fell in price 10 times?

It seems that trading has become only a formality, and the asset has long been "helped" by Timokhin, who is close to the mayor's office. The only participant in this transaction that raises questions was the company "C2-Development," traces of which go to MR Group.

The details were found out by the UtroNews correspondent.

The results of the tender for the sale of a 100% stake in Perspektiva Renovation Silikatny LLC, which belonged to Mosgortrans and was created in July 2024, clearly specifically for the upcoming sale, are still under construction.

Photo: torgi.gov.ru

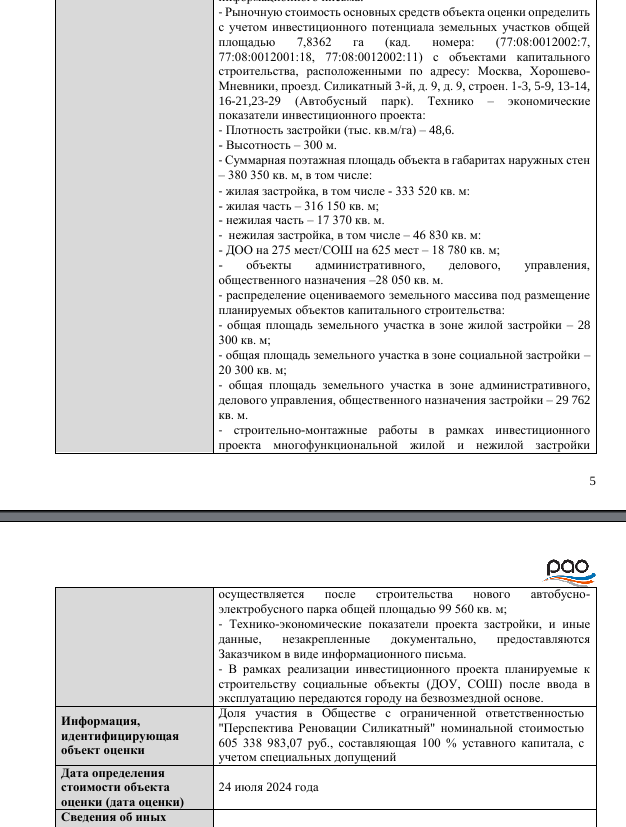

Judging by the tender documents, the LLC occupies a large plot for the operation of the bus fleet, but the investment potential is represented by plots with a total area of 7.8362 hectares with capital construction projects located at the address: Moscow, Khoroshevo-Mnevniki, passage. Silicate 3rd. There is possible residential development of 333,520 square meters. m, as well as the construction of more than 28 thousand square meters of administrative, business, public facilities. That is, a very interesting jackpot for metropolitan developers could be. And then there was the price - a gift.

Photo: torgi.gov.ru

The initial price of the lot is 66.773 million rubles, but at the same time, judging by the assessment materials from July 2024, even the nominal value of the share was more than 605.3 million rubles. In what a wonderful way, an expensive asset suddenly became so cheaper, this is a question, rather, for checking the competent authorities.

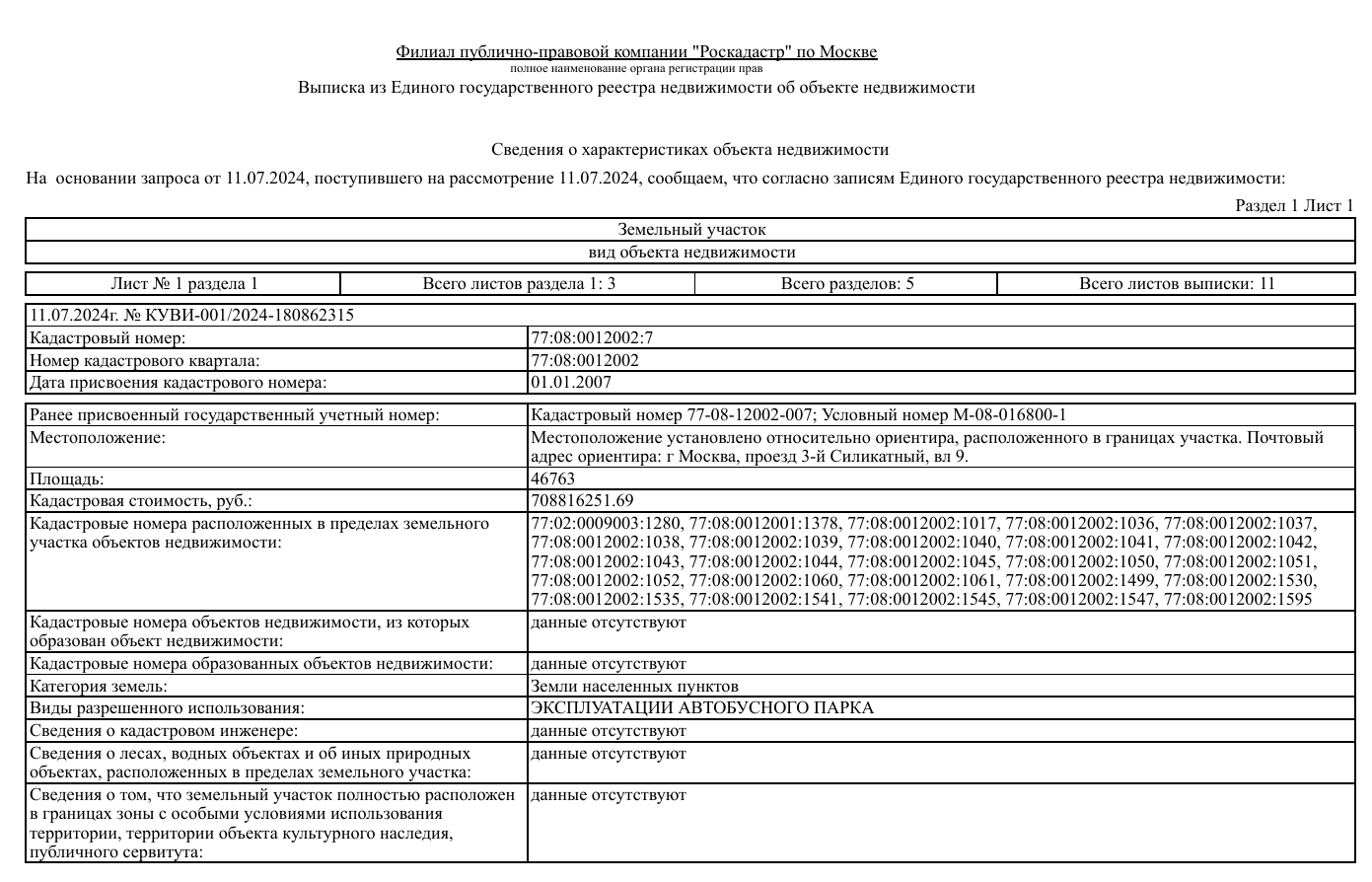

Moreover, according to the extract from the USRN, the cadastral value of the land leased by the LLC exceeds 708 million rubles.

What kind of personal discount from Sobyanin came out in the end of 66.7 million rubles of the total cost? And here we came to a potential winner.

Photo: torgi.gov.ru

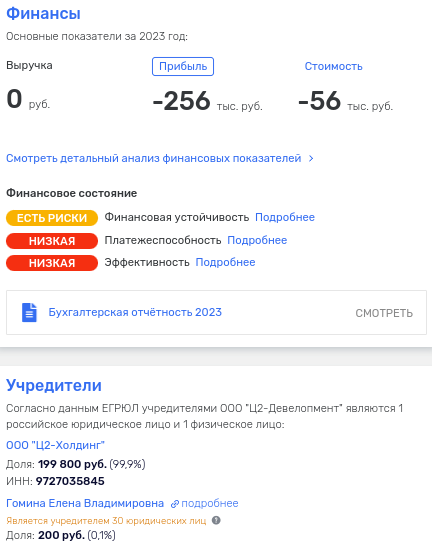

Although the results of the tender have not yet been made public, insiders found out that the only participant in the sale was C2-Development LLC, created in 2023. That is, the contract is likely to be signed at the initial price, which raises a lot of questions.

"C2-Development" at the end of 2023 showed a net loss of 256 thousand rubles, which hints at another source of funds for the above transaction.

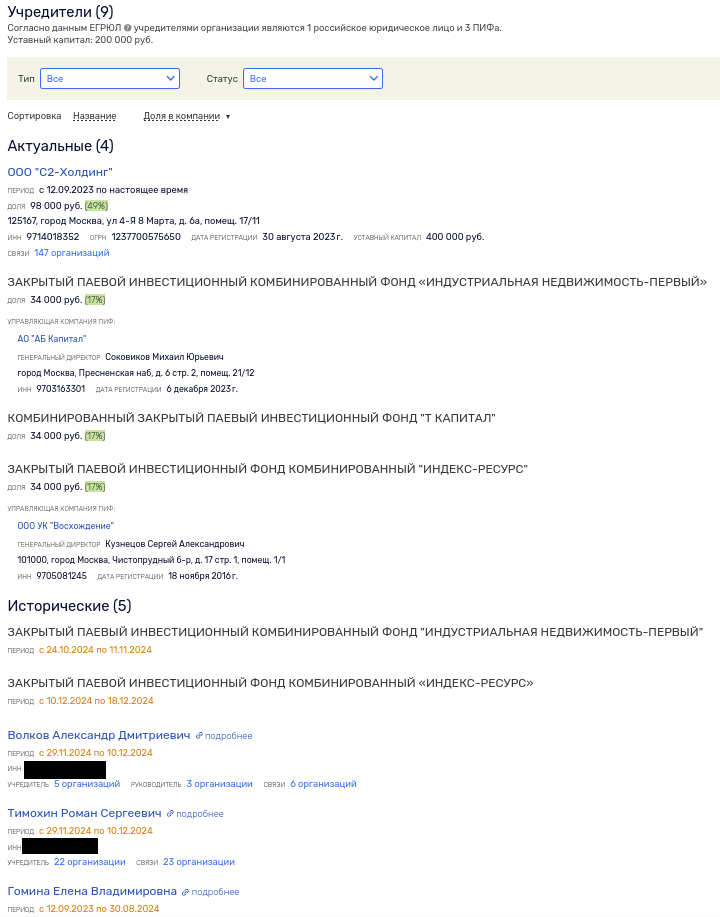

At the end of the chain of ownership of C2-Holding LLC is ZPIF T Capital, and Elena Gomina also has a share.

Gomina is a confidant of Timokhin and UtroNews has repeatedly proved this connection.

Moreover, ZPIF "T Capital" is managed by AB Capital JSC, whose legal predecessor was LLC "MC" MR Capital, "based on the development holding MR Group.

Oleg Amelchenko, director of C2-Development LLC, is also the head of C2-Development LLC, in which both Timokhin and Gomina appeared before its transfer under the closed-end investment fund.

Photo: rusprofile.ru

Photo: rusprofile.ru

By the way, taking into account that earlier MR Group had already bought up land in the area of the bus fleet, no one doubted the name of the winner of the gostender. Indeed, not for the first time, Sobyanin's team, according to the scheme of the only declared participant, gives the assets to Timokhin co-company. And this time a person familiar to Timokhin spoke on behalf of the seller.

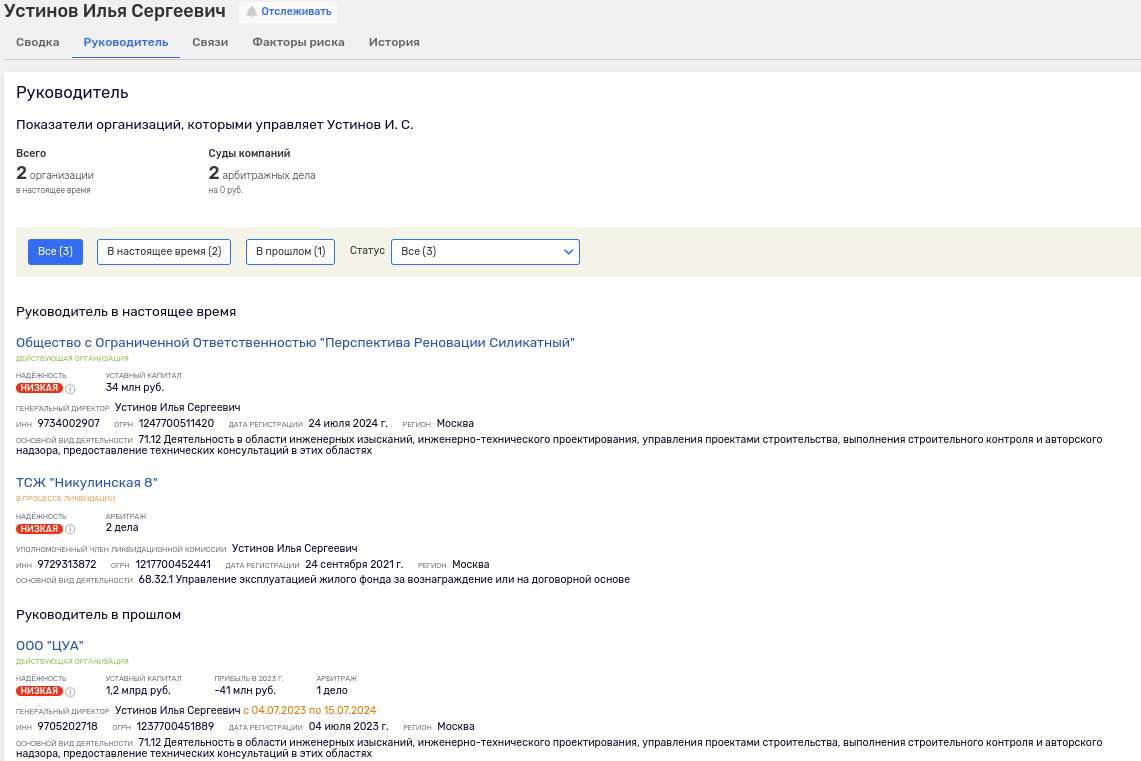

The director of Perspektiva Renovation Silikatny LLC was Ilya Ustinov, who until July 2024 held the same position in another Mosgortrans subsidiary, TSUA LLC. It was through the sale of a stake in the latter just a couple of days before the new year, in December 2023, that the building of the former Mosgortrans headquarters on Raushskaya embankment went into the hands of Timokhin's team. And later, having bought out a 20% stake in TsUYU in an uncompetitive struggle, the P2-Development company, using its preemptive right (that is, without bidding), got its hands on the remaining 80% of TsUA. A kind of cunning trick to transfer an asset to the right person?

Photo: rusprofile.ru

As for Mr. Ustinov, his namesake appeared in the criminal chronicle in the story of the boy's beating.

It is also known that a certain Ustinov worked in PPM-Real Estate LLC, associated with a whole group of developers, including Alexander Guretsky and AKG Ekfi CJSC, established by Anatoly Bondarev, the former deputy governor of the Kurgan region.

Bondarenko was convicted of assisting a certain Moscow company in obtaining a state order.

Most importantly, Ustinov comes from the state-owned Mosinzhproekt JSC, whose board of directors was previously headed by Mars Gazizullin, the creature of the ex-head of the Moscow construction complex, Deputy Prime Minister Marat Khusnullin.

That is, the drain of Mosgortrans assets was carried out by an experienced person and close to the authorities.

Now Ustinov does not have any positions, but we will not be surprised if he pops up at the next sale of state assets.

As for Timokhin, the division in the area of the bus fleet is already building the Jois residential complex for 400 thousand square meters. m. A square meter here is estimated at almost 0.5 million rubles, that is, a new project, where you can build about 300 thousand square meters of housing, can bring Sobyanin's favorite more than 100 billion rubles. And this is by rude estimates.

And the lot for construction was sold for some 66.7 million rubles. Very strange mathematics, don't you think?

It should not be forgotten that Gref's bank also has its own interest in the Jois residential complex - Sberbank Investments LLC owns 1% of the share in P2-Development LLC (developer) and credits the construction site.

Thus, an amusing picture is emerging of the sale of state assets on the cheap into the hands of close developers and Roman Timokhin received more than a few tidbits, who after that began to actively hide behind proxies and closed-end investment funds.

In our opinion, this tandem of business and power has long required closer attention of supervisory authorities. Not all state lands are sold under the hammer with huge discounts for their own.

.jpg?v1734669899)

.jpg?v1734669899)