Oligarch Albert Avdolyan, it seems, does not abandon attempts in the history of the bankruptcy of the scandalous holding Mezhregionsoyuzenergo (MRSEN) and have his margin from this. We can talk about 4.5 billion rubles.

Dubious companies, whose claims are more like an attempt to withdraw part of the capital, including through offshore companies associated with Avdolyan, have been squeezed into the ranks of MRSEN's creditors. Banks affiliated with MRSEN shareholder Eldar Osmanov, who was a relative of Avdolyan, were also involved in the energy holding scam. The Moscow Post correspondent understood the story of dubious bills, loans that smell bad.

Recall that in 2021 it became known about the disclosure of a whole criminal message, which was suspected of withdrawing billions of rubles abroad stolen from electricity producers and grid companies from the Rosseti division. The defendants in the case were 11 people, including the ex-leaders of Arkhenergosbyt, Vologdaenergosbyt, Roskommunenergo, Khakasenergosbyt, Chelyabenergosbyt, ex-manager of Mosuralbank JSCB Nikolai Korneev.

According to the investigation, the OPS worked under the cover of Mezhregionsoyuzenergo JSC, which was headed by Eldar Osmanov, Yuri Shulgin and Bagrat Katalyants.

Companies controlled by MRSEN issued loans, bought bills and shares, contributed money to the authorized capital of third-party legal entities, and assigned claims. That is, having collected money from consumers, they did not inform them to the addressees, scrolling through cunning schemes that finished abroad. Transactions were financed through technical loans issued by Mosuralbank. As a result, in 2004-2019, over 10 billion rubles were withdrawn abroad.

In September 2023, the investigation of the criminal case was completed, but not all the defendants are in jail and are waiting for a verdict. So, Osmanov and Shulgin are still wanted today, as they managed to escape from justice.

Earlier, The Moscow Post talked about the methods of the dashing 90s, which tried to force a witness in the MRSEN case, Tatyana Romanova, to silence. Today we will dwell on how the name of Albert Avdolyan, who was previously noted not from the best side in history about the inheritance of businessman Dmitry Bosov, who died under mysterious circumstances, lit up.

Avdolyan hurt a relative?

At the time of the peak of the scam, Mr. Avdolyan was a relative of the now fugitive Eldar Osmanov - their children got married in 2017, marking this event on a large financial scale against the backdrop of huge debts of the MRSEN. A year later, the young officially divorced, but, apparently, business relations between Avdolyan and Osmanov remained.

In 2018, the Ministry of Energy for debts deprives MRSEN of the status of a guaranteeing supplier in a number of regions - in the division it begins to smell of real problems. And here, as if the hell from the snuff box in March 2018, a certain AENP LLC appears.

Photo: rusprofile.ru

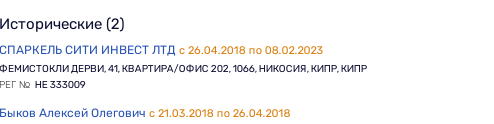

The founder of this LLC almost from the moment of creation (from April 2018) to February 8, 2023 was the Cypriot company Sparkel City Invest LTD.

Photo: rusprofile.ru

That offshore, that AENP is starting to actively sue MRSEN and its "daughters" from the threshold, many of whom were already in the pre-bankruptcy and bankruptcy stages, trying to collect some debts.

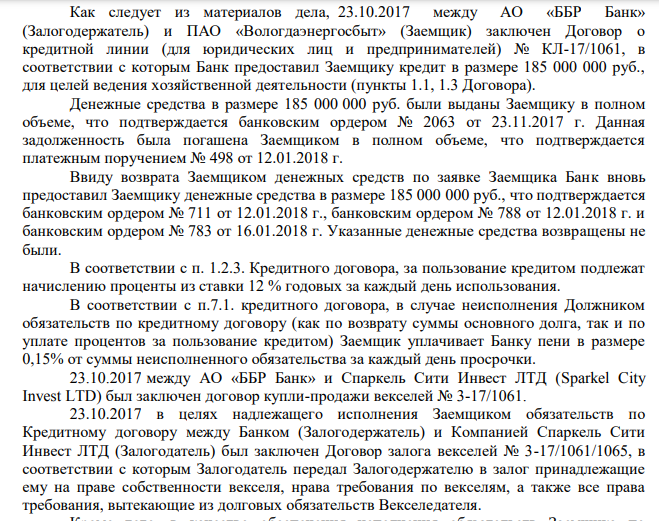

For example, from the materials of the case considered in 2020, it is known that in October 2017, BBB Bank JSC issued a loan to Vologdaenergosbyt for 185 million rubles for economic activities. During the same period, a purchase and sale agreement was allegedly concluded between the bank and Sparkel City Invest LTD, which pledged the loan. After the debt was not repaid, promissory notes were collected and the offshore company received the right of recourse from the debtor.

Then in May 2018, allegedly between the Cypriot company and the already created AENP LLC, an agreement was concluded on the assignment of claim rights with Vologdaenergosbyt.

The claim of "AENP" then lost, the court pointed to the affiliation of the group, including the creditor bank, in order to gain control over the bankruptcy procedure, the distribution of the bankruptcy estate in favor of a "friendly" creditor to the detriment of the interests of other creditors. The trick didn't ride.

Photo: kad.arbitr.ru

According to similar schemes, AENP and its owner, an offshore company, tried to get into many financial disputes and operations of the MRSEN division. MRSEN's subsidiaries began to bankrupt back in 2017-2018, that is, AENP could well have been created precisely for the purpose of controlled bankruptcy and attempts to withdraw MRSEN funds under the guise of debt collection.

Photo: kad.arbitr.ru

Photo: kad.arbitr.ru

An interesting fact: it was one of the "daughters" of MRSEN that eventually filed a bankruptcy lawsuit against the parent company in 2021.

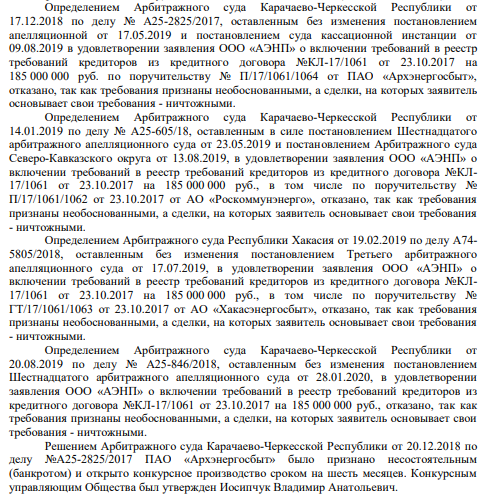

Later, in the materials of one of the litigation already on a loan for PJSC Arkhangelsk Sales Company, the court will directly indicate that the offshore Sparkel City Invest LTD, and therefore the AENP company, is associated with Albert Avdolyan, a relative of Osmanov, indicating the wedding of children in July 2017.

At the same time, according to the courts, "on the date of the conclusion of the loan agreement and surety agreements, E.H. Osmanov was simultaneously formally affiliated with Sparkel City Invest LTD (lender), with the beneficiary of Sparkel City Invest LTD and Smart Resolut LTD Avdolyan AA, with the owner of 30% shares of JSC" BBB Bank "Gordovich D.G. and with the sole executive body of PJSC" Arkhangelsk Sales Company. "

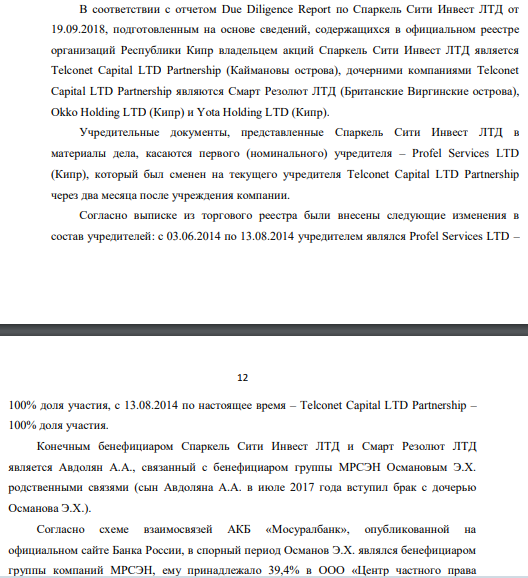

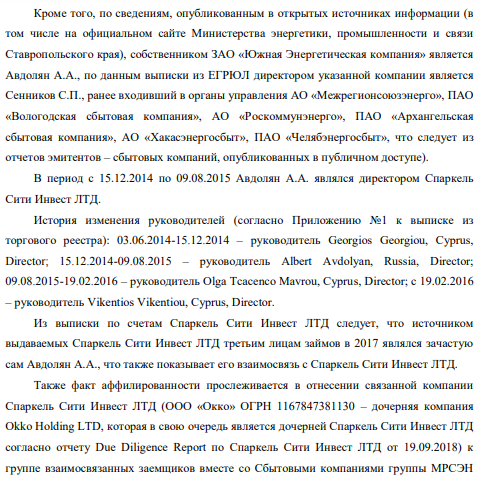

From the materials of the court it follows that the owner of Sparkel shares was Telconet Capital LTD Partnership (Cayman Islands), and the subsidiaries of the latter were Smart Resolute LTD (British Virgin Islands), Okko Holding LTD (Cyprus) and Yota Holding LTD (Cyprus). At the same time, the Cypriot Sparkel itself for some reason submitted only documents in the materials of the courts that concerned the first (nominal) founder - Profel Services LTD (Cyprus), which was changed to the current founder of Telconet Capital LTD Partnership two months after the establishment of the company. The courts directly named the oligarch Avdolyan, a relative of the beneficiary of the MRSEN group Osmanov, as the beneficiary.

Photo: kad.arbitr.ru

In addition, it follows from the materials of the courts that Avdolyan A.A. is the owner of Southern Energy Company CJSC, and S.P. Sennikov, who had previously been a member of the management bodies of MRSEN and its subsidiaries, was the director of the company. In addition, Albert Avdolyan was not just a beneficiary of Sparkel, but from December 15, 2014 to August 9, 2015 he was a director of the company. And most importantly - "the source of loans issued by Sparkel City Invest LTD to third parties in 2017 was often Avdolyan A.A. himself, which also shows his relationship with Sparkel City Invest LTD."

Photo: kad.arbitr.ru

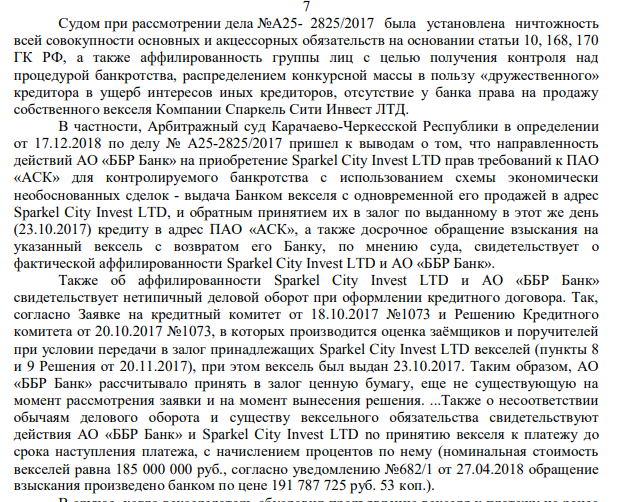

The court also pointed to a not typical business turnover when issuing loans with the participation of Sparkel City Invest LTD, BBB Bank and the MRSEN group. The bank did not even assess the existence of obligations from borrowers and guarantors.

Maybe the competent authorities will pay attention to another episode for a criminal case, where it is useful to talk with Mr. Avdolyan

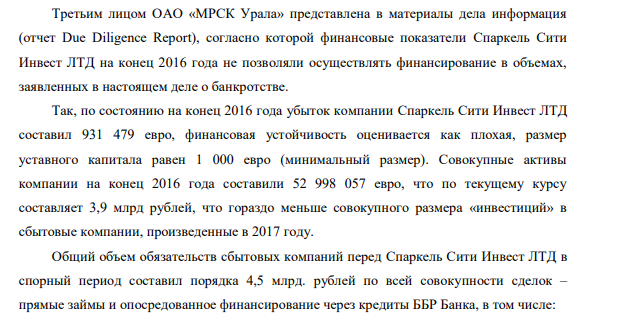

In the same case, the creditor - IDGC of Urals cited evidence that at the end of 2016 Sparkel City Invest LTD could not finance MRSEN in any way, since it itself was in losses of 931 thousand euros, and the financial stability of the company was estimated as poor. It was noted that Sparkel's total assets were about 3.9 billion rubles, which is much less than the total amount of "investments" in sales companies made in 2017.

In general, the debt of MRSEN sales companies to the Cypriot company was declared at the level of 4.5 billion rubles for all transactions - from direct loans to indirect financing through loans from the Bank's BBB. At the same time, future defendants in the criminal case Osmanov and Shulgin, as well as the "daughters" of MRSEN, acted as guarantors for a number of these loans. That is, the debts were "on paper," and they wanted to collect them with "real" money. Are these not signs of fraud?

By the way, the same report, compiled at the request of IDGC of Urals, the offshore tried to appeal in court, asking to recover 4 billion rubles in losses from the compiler and claiming falsification. The court, however, did not believe in these next tales and refused the claim.

Photo: kad.arbitr.ru

What do we end up with? An offshore company affiliated with Olgigarch Avdolyan creates a Russian legal entity, together with which it is trying to take control of the bankruptcy of MRSEN companies, whose shareholder - a member of an organized criminal community (according to the investigation) - was a relative of Avdolyan. At the same time, various kinds of scams with bills and loans are used, which have already been opened and highlighted in a dozen court decisions.

The question is, where is the criminal case against these defendants, by the way, who do not leave attempts to get into the register of creditors of the MRSEN and its "daughters" to this day?

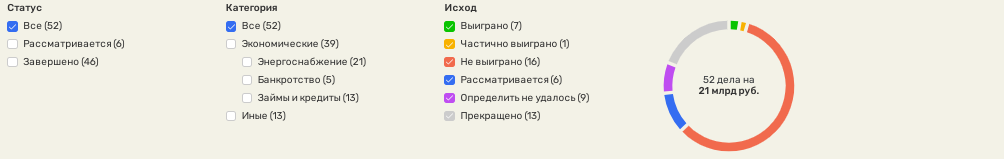

For reference: during its existence, AENP acted as a plaintiff in 52 arbitration cases totaling 21 billion rubles. Almost all of them are associated with companies affiliated with MRSEN.

Photo: rusprofile.ru

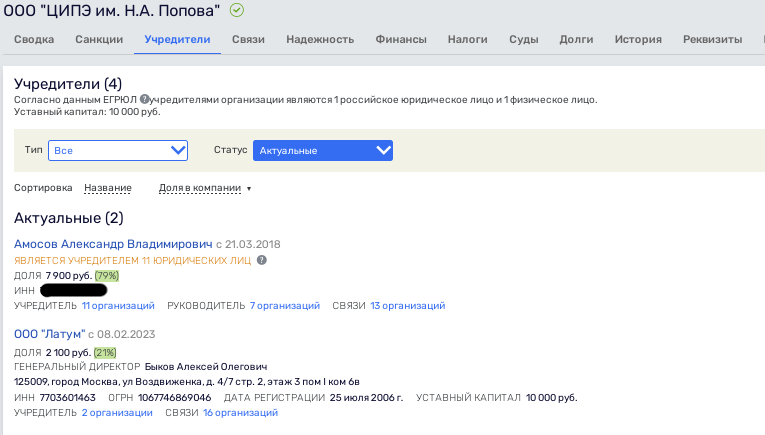

Today the company "AENP" has not gone anywhere, it is quite operational. And in September 2023, it was completely renamed LLC "CIPE named after N.A. Popova." In addition, the offshore company was removed from the owners in 2023. After all, in fact, the refusal to include in the list of creditors was largely justified by Avdolyan's affiliation, as the beneficiary of Sparkel with Osmanov. Apparently, there will be another attempt to get into the bankruptcy procedure.

The new owners of the former AENP, and now the Popov CIPE, are Alexander Amosov with a share of 79% and since February 2023, a certain Latum LLC, which was established by the same Amosov and Alexey Bykov. But Amosov has been the owner of a stake in AENP since its inception (since March 2018), and Bykov has been the director of this company since that moment. That is, their connection with the same Avdolyan is obvious. Moreover, the same Mr. Bykov is a co-owner of Andayana Group LLC, and among his business partners in the asset is the general director of YATEK Andrei Korobov. YATEK is part of the Avdolyan division.

In fact, AENP only rearranged the terms, from which, as you know, the amount does not change.

Photo: rusprofile.ru

In addition, the same Amosov created a brand new asset in 2022 - a certain Staccato Investments LLC, which from January 14, 2024 is registered at the same address as the former AENP. Another "reserve player" for the story with MRSEN?

Today, the courts are hearing cases on the termination of a huge package of MRSEN transactions. For example, at the end of January 2024, the court plans to consider the requirement to invalidate the transfer of 17.441 million rubles from the MRSEN account to Yu.V. Shulgin, another beneficiary of the company, who, following the example of Osmanov, went on the run. As reported by Versiya, Osmanov and Shulgin, who had citizenship of the island state of St. Kitts and Nevis, could withdraw about 650 thousand US dollars in favor of Henkley and Partners Ltd (Channel Islands) through Mosuralbank, controlled by MRSEN AKB.

The "burst" Mosuralbank, whose beneficiary was Osmanov, also today does not abandon attempts to become a creditor to MRSEN. It is also funny that Osmanov himself, hiding from the investigators, is actively involved in the bankruptcy process of the MRSEN. Literally on January 16, he filed a certain statement about falsification of evidence. Apparently, together with Avdolyanov firms, he still hopes to introduce "his people" into the register of creditors. Maybe it will be possible to snatch something. The only question is why Sledkom looks calmly at all these financial scams?

.jpg?v1706070065)

.jpg?v1706070065)