On the dock for embezzlement of billions of rubles from Finprombank will be an ordinary "switchman," who will be released in six months?

In Moscow, the court began to consider a criminal case on the embezzlement of almost 900 million rubles from Finprombank. Apparently, they decided to "hang the blame" on the deputy head of the bank's credit department, Alexander Lavrentiev. The names of its owners do not appear in the case.

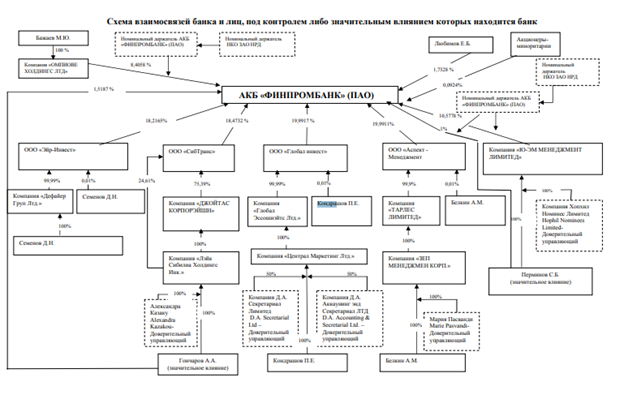

Meanwhile, according to the latest data from the industry publication Banki.ru, the main owners of the monetary institution were Pyotr Kondrashov (19.99%), Andrey Belkin (19.99%), Anatoly Goncharov (19.99%), Dmitry Semenov (18.22%), Stanislav Perminov (11.58%), Musa Bazhaev (8.41%), Evgeny Lyubimov (1.73%).

Some of these comrades have already been honored to become heroes of the publications of our publication. Details - in the material of the correspondent of The Moscow Post.

Stranger Things

Let us recall the history of this case. The investigation found out that the money scam was tested in 2015-2016. Then "unidentified persons, under the guise of concluding a number of civil law contracts that they did not really intend to fulfill, committed the theft of funds of PJSC JSCB Finprombank for a total amount of over 5.6 billion rubles."

And here immediately a reservation - in the current criminal case Lavrentiev appears alone. And also, as proven in court, he by the nature of the position could not influence the credit policy of Finprombank. In addition, Lavrentiev has a mortgage and dependent relatives. Surely they would have lived better if Comrade Lavrentiev had stolen 5.6 billion rubles. Or does the investigation believe that he - like Koschey the Immortal - "will wither over gold"?

At the same time, it is known that the largest non-refundable loan in the amount of $11 million was issued by Finprombank to the co-owner of the Asia-Pacific Bank (ATB), the ex-owner of the ABC of Taste network Andrei Vdovin. But he cannot be obtained - the businessman was arrested in absentia before this case and put on the international wanted list as part of an investigation into billions of dollars in embezzlement of funds in the ATB itself. Nevertheless, why he was not presented with demands within the framework of this story is still a mystery.

Bazhaevsky castling

As for the shareholders of the company themselves, there are many noteworthy persons. Let's start with Musa Bazhaev, who owned almost 20% of the shares/

Photo: https://analizbankov.ru/depend_pdf/RB2157_20160628.pdf

Bazhaev as a shareholder was present in the bank until 2013, then came out and returned back in 2015 under the slogan of "improving the structure." Anatoly Goncharov, another shareholder and Musa's old friend and partner, called him.

It was in those years when the latter again became the owner of the structure that it was, the essence, robbed of 5.6 billion rubles. It is faintly believed that Bazhaev, who came to establish the financial component of a monetary institution, was neither a dream nor a spirit.

At the same time, it was according to Bazhaev's statement that Finprombank revoked its license in 2016. As they explain such a "re-shoe" from the oligarch in the media - initially he did not assume that everything was so bad in the bank, but as he understood it, he decided not to lose money anymore and send the asset "to rest."

It is also hard to believe, because Bazhaev was absent from the bank for only a couple of years. And then there was his personal money. Taking into account his relationship with Goncharov, it seems that in fact Bazhaev continued to monitor or at least receive information about cases within the company. And, who knows, maybe even came out of it due to the fact that something like what happened in the end was preparing. But without Bazhaev, it may have become difficult to implement the plan.

He returned, most likely due to connections and the ability to attract loans. Perhaps at that time it was this ability that was needed by the "sinking" asset in order to "bleed" it quickly and with maximum profit for the participants in the scheme.

This version seems the most digestible, given the fact that just before the collapse, the bank decided that it was not at all difficult for it to also issue large loans - including to the structures of Mr. Vdovin.

Bazhaev himself is a very ambiguous personality - it was rumored that several oil depots of Krymnefteprodukt "were" not quite legally "transferred to the ownership of the Bazhaev family using the Seilem organized crime group.

By the way, in the same 2016, when Finprombank collapsed, Musa Bazhaev bought 30% of Petropavlovsk Group of Companies, one of the country's largest gold miners. Isn't Finprombank's money?

All offshore?

Ah, yes, from the bank's annual report it became known that part of the funds in the form of loans went to the structures of Mr. Bazhaev - which, in fact, raises the question of a conflict of interest. But everything would be fine if not for another document walking on the Web.

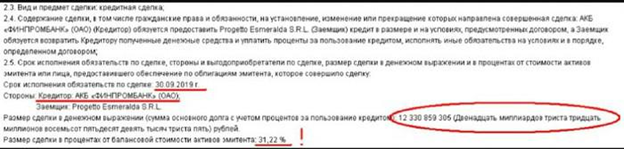

It states that the bank issued a loan of 12.3 billion rubles to the offshore company Progetto Esmeralda SRL, which managed the Italian resort Forte Village in Sardinia. We do not vouch for the authenticity of the paper. But we emphasize that Progetto Esmeralda SRL belongs to Luxembourg Sonogest S.A.R.L., and it is registered in Cyprus Quarmine Limited. On 12 February 2013, the owners of Quarmine were two companies incorporated in the British Virgin Islands - Alivar Holding Limited and Daminn Capital Limited (50% each). Both appeared in the list of affiliates of the Alliance Group of the Bazhaev family, as Forbes writes.

Photo: https://www.compromat.ru/page_44441.htm

So what kind of recovery could we talk about at all, when the structure seems to have been used as a "cube"?

By rolled

What is also important to emphasize in this story - the owners of Finprombank Dmitry Semenov, Anatoly Goncharov, Peter Kondrashov, Andrei Belkin, Stanislav Perminov and Evgeny Lyubimov were the ultimate beneficiaries of another credit and money institution, namely, CB iManiBank LLC. The latter also crashed in 2016. Before that, having limited the issuance of deposits and eventually owed billions of rubles to creditors.

The story is almost similar - this time everything was attributed to the former board of the bank Igor Volchikhin, who went to jail, because, according to investigators, he issued a deliberately bad loan to the retailer Wikimart.

Doesn't it resemble anything? Why in the structures of Bazhaev and Co., hired managers commit the same fraudulent actions? And is they not supervised by one of the bank owners?

Indeed, literally after five months of imprisonment, Volchikhin returned home as if nothing had happened. Gratitude for the silence? Perhaps, in the case of Finprombank, they also agreed with the alleged "switchman"?

What is still funny is the situation with Finprombank is the position of the former director of Wikimart Maxim Faldin - in 2016 he said that "the company was" stolen "and will be declared bankrupt."

Goncharov invested in Wikimart in 2015. Something investment from Bazhaev and his comrade is a little toxic, judging by what happens to the assets later...

Goncharov, according to RBC, was put on the international wanted list. But something has passed since then for three years, and he was not even presented with theft in Finprombank in absentia.

At one time, Goncharov appeared in a scandal with a loan for the owner of the Svyaznoy Group of Companies Maxim Nogotkov. Svyaznoy received $11 million from Goncharov's offshore company UM Management Limited. But he could not give the funds on time, and as a result, Oleg Malis bought the right to claim the loan. There is talk that the situation with the loan from Goncharov could be a multi-move on the likely raider seizure of Nogotkov's business.

Bazhaev, Goncharov and Co

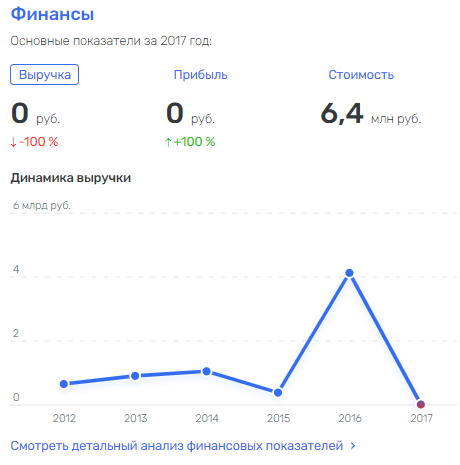

As for other shareholders of the monetary institution, these are unpopular people and, most likely, are friends-comrades of Bazhaev and Goncharov. Peter Kondrashov, for example, owned a stake in a number of Cypriot firms associated with the bank. Global Invest was registered for it in Russia. The office could be used to withdraw money - its revenue ranged from 4.1 billion rubles to zero and now it has been liquidated.

Photo: Rusprofile

In general, if you look at the structure of the owners of Finprombank, it turns out that the shares were mainly controlled through offshore companies. The big question is why the presence of foreign accounts did not attract the attention of law enforcement officers.

Summing up, this whole story looks very suspicious. "Holes" everywhere - from the mortgage of the main accused to offshore the main beneficiaries of the institution and coincidences in the cases of "Aimanibank." Bazhaev, Goncharov and Co could take billions abroad, and the usual "switchman" will be punished for this?

.jpg?v1701234896)

.jpg?v1701234896)