How are the revocation of a license from a network of clinics and a large bank related.

Behind the problems of the Euroonko clinics could be Transcapitalbank Olga Gryadova and her husband? According to the correspondent of The Moscow Post, in Moscow, law enforcement officers opened a criminal case due to forgery of documents on the basis of which the Euroonko network of clinics specializing in the treatment of cancer remained without a license.

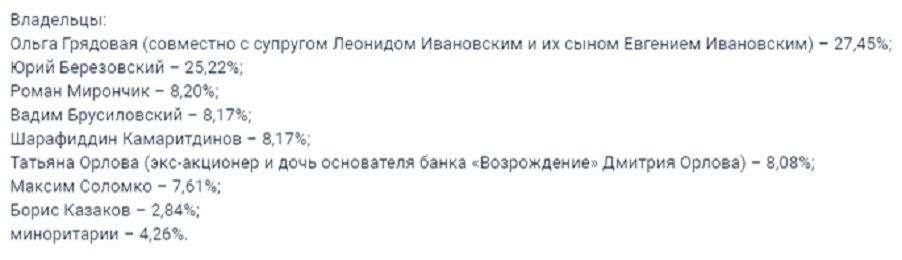

Our publication conducted an investigation, and tried to find out who could be involved in this crime and what are the beneficiaries of PJSC Transkapitalbank (TKB). Namely, his majority owners Olga Gryadovaya, and her husband Leonid Ivanovsky. Recall that together with their son they own 27.45% of the shares.

The investigation into the criminal case of forgery of documents began on the basis of a statement by the management of the Center for Innovative Medical Technologies LLC - the legal entity of the Euroonko clinic. They learned about the revocation of the license for the provision of services and their LLC, and the related termination of activities.

It turned out that some fraudsters sent an appeal to the Moscow Licensing and Accreditation Department to revoke the license, to which the company's management was not related. Moreover, there were no grounds for terminating the license. A network of clinics tried to appeal these actions in the Moscow Arbitration Court, but did not succeed and turned to the police.

Who could need to stop the company, and even in this way? There is a possibility that this is the one to whom the company owes money. But not so much and not so much that it becomes the basis for the termination of work. And here interesting details are found out.

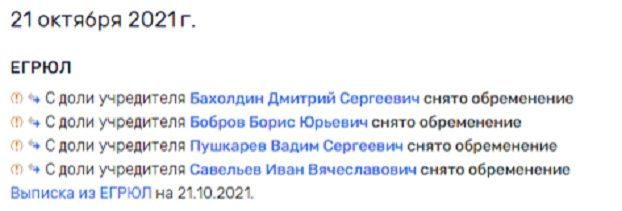

The whole story of the filing of fraudulent, as expected, documents occurred in September 2021 - since then the clinic could not work normally. And in October, the owners of the legal entity of the network of clinics, LLC Center for Innovative Medical Technologies. And in October, the encumbrance under which their shares in the company were removed from the four majority owners of the structure, namely Dmitry Bakholdin, Boris Bobrov, Vadim Pushkarev and Ivan Savelyev.

Yes, just like that - it turns out that the company was under encumbrance, and not somewhere, but just in Transcapitalbank, which is 27.45% owned by the family of Olga Gryadova and Leonid Ivanovsky.

Yes, just like that - it turns out that the company was under encumbrance, and not somewhere, but just in Transcapitalbank, which is 27.45% owned by the family of Olga Gryadova and Leonid Ivanovsky.

Is it possible that debtors were pushed in a certain way to pay debts or remove the encumbrance, not being able to influence the owners of the company in another way?

Is it possible that debtors were pushed in a certain way to pay debts or remove the encumbrance, not being able to influence the owners of the company in another way?

Another interesting point is Leonid Ivanovsky is a professional lawyer and allegedly conducts notary and notary activities related to the Moscow City Notary Chamber. And this information only increases suspicions that the forged document, on the basis of which the work of the Euroonko network was temporarily frozen, could be delivered by the owners of Transcapitalbank.

Money stream from the state

As for the bank, this structure itself is very interesting. In total, for the August-September month of 2019, TKB suddenly lost 20% of its profit. In addition, the bank finished the 2018 year with a major loss of over 700 million rubles. At the same time, investors were told that everything was fine, and rumors crawled on the market that the structure was engaged in extremely dubious activities.

In particular, the TKB and its leadership tried to connect with an attempt to create the first telegram bank in Russia - on the basis of a popular messenger, which is not inferior in functionality to many social networks. We are talking about a TalkBank who disappeared from public space, barely appearing there.

In particular, the TKB and its leadership tried to connect with an attempt to create the first telegram bank in Russia - on the basis of a popular messenger, which is not inferior in functionality to many social networks. We are talking about a TalkBank who disappeared from public space, barely appearing there.

It turned out that the Internet Initiatives Development Fund even invested in TalkBank, but this is public money. Then the structure was also associated with two Russian startups Mikhail and Alexander Popov. Where the 66 million rubles they received went is still not clear, but it was Transcapitalbank that could be their banking base structure.

After all, it was TKB that issued cards for TalkBank, and none of the owners completely hid this. At this time, the Popovs brought their program to the market and participated in international competitions. At the same time, for some reason, the TKB client base allegedly began to grow from a startup with state financing. Coincidence?

Be that as it may, the observer of the TCB will notice that this is far from the only time when the structure could touch budget money.

In 2015, the TKB, it is not clear for what merits, received 19.5 billion rubles from the Central Bank for the reorganization of Investorgbank (ITB) and with it. With maturity in 2017 and 29.7 billion rubles with maturity in 2025. Olga Gryadovaya probably counted on this money. What is the result of reorganization, because today 100% of the structure also belongs to TKB?

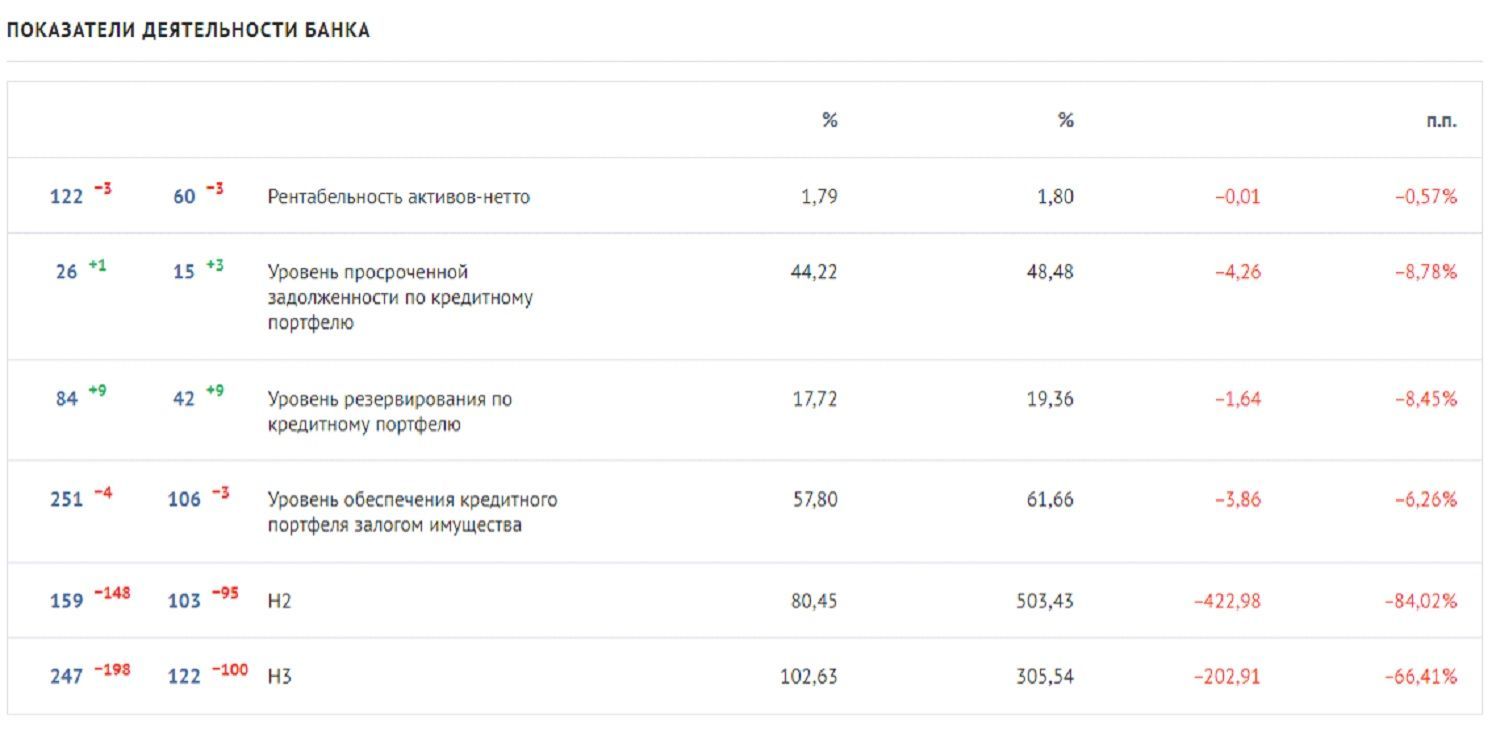

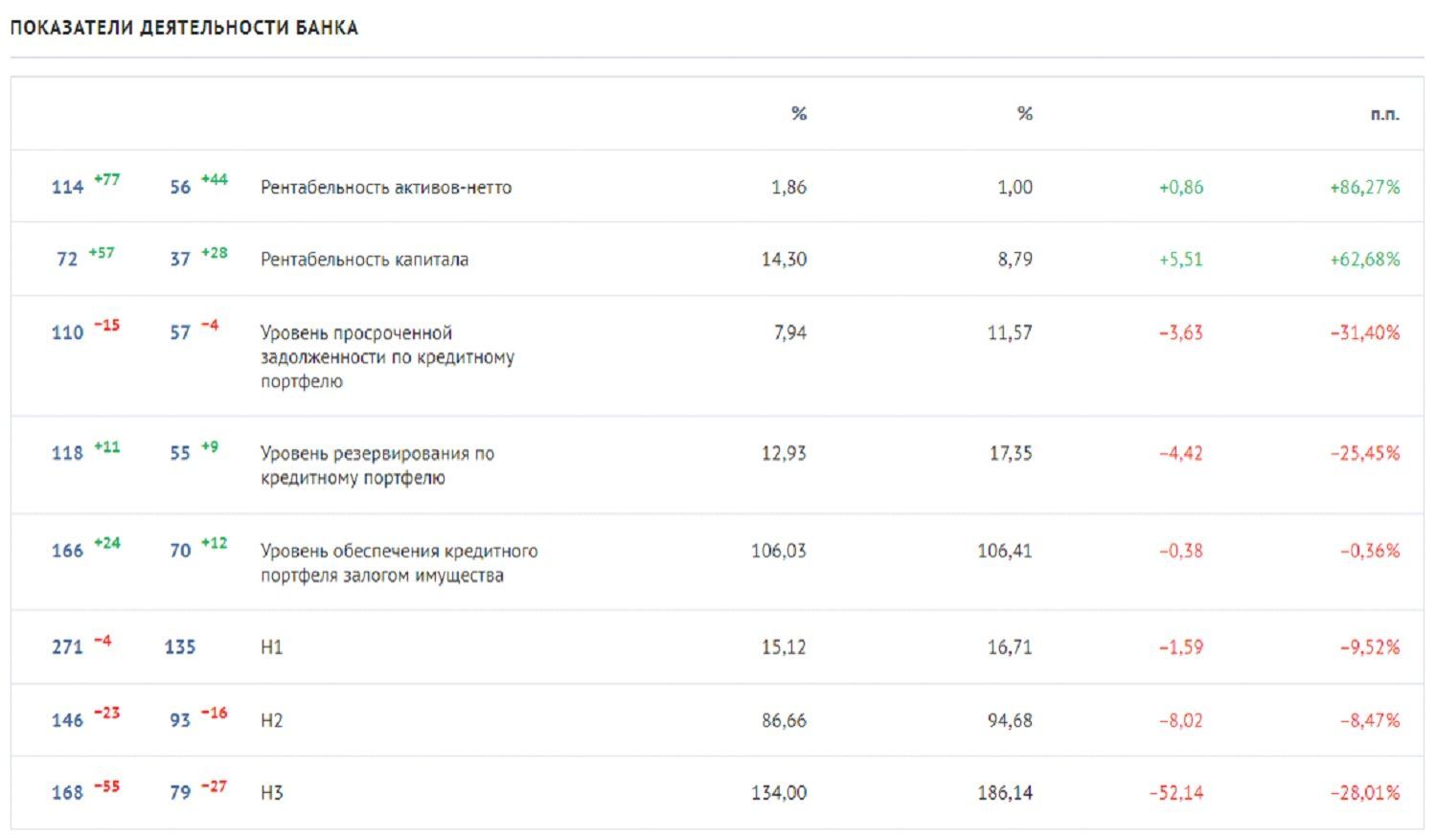

If we take the result from May to the end of October 2021, that is, the most recent, operational indicators, then a lot of questions may arise for the credit institution. The profitability of assets is falling, the level of overdue debt on the loan portfolio is growing. More oddly, the two most important credit ratios of the bank H2 and H3 ended up in the red zone with wild indicators of -84% and -66%. And the first coefficient, H1, was not at all in financial information.

Strange things also happen in the organization's subsidiaries. For example, in the process of liquidation is the company LLC ITB-Semimorye, a subsidiary of ITB. At the end of 2020, her revenue is only 3 million rubles. But the net assets of the structure are negative - minus almost 160 million rubles! In addition, the authorized capital of the company is over 28 million rubles, but officially only two people work in the state. These are clear signs of fictitiousness, which may indicate a possible withdrawal of money from the banking structure.

Strange things also happen in the organization's subsidiaries. For example, in the process of liquidation is the company LLC ITB-Semimorye, a subsidiary of ITB. At the end of 2020, her revenue is only 3 million rubles. But the net assets of the structure are negative - minus almost 160 million rubles! In addition, the authorized capital of the company is over 28 million rubles, but officially only two people work in the state. These are clear signs of fictitiousness, which may indicate a possible withdrawal of money from the banking structure.

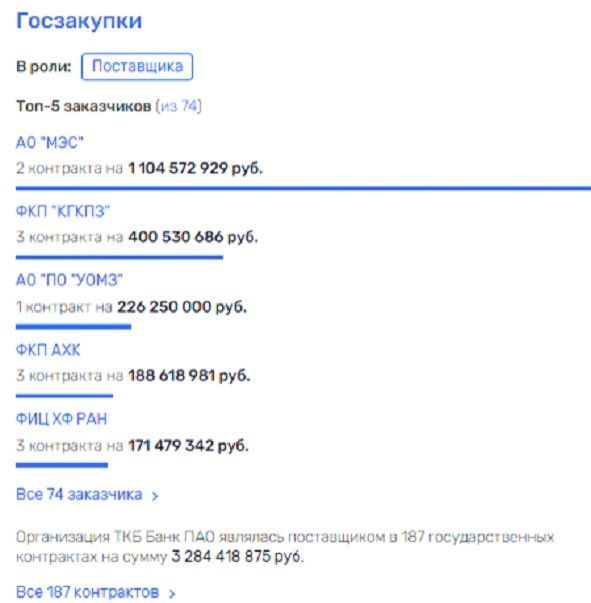

The same can be said of many other of the 20 subsidiaries. At the same time, the amount of state contracts of the bank with various authorities and institutions almost reached 500 million rubles.

Regarding state contracts, this is not so much compared to the TKB managed by Gryadova and Ivanovsky. The bank has already scored state contracts in the amount of 3.2 billion rubles. Most of them are from the state-owned Murmanelektrossbyt JSC, which in 2020 had a loss of 784 million rubles. The question of whether budget money flew to a private bank remains open.

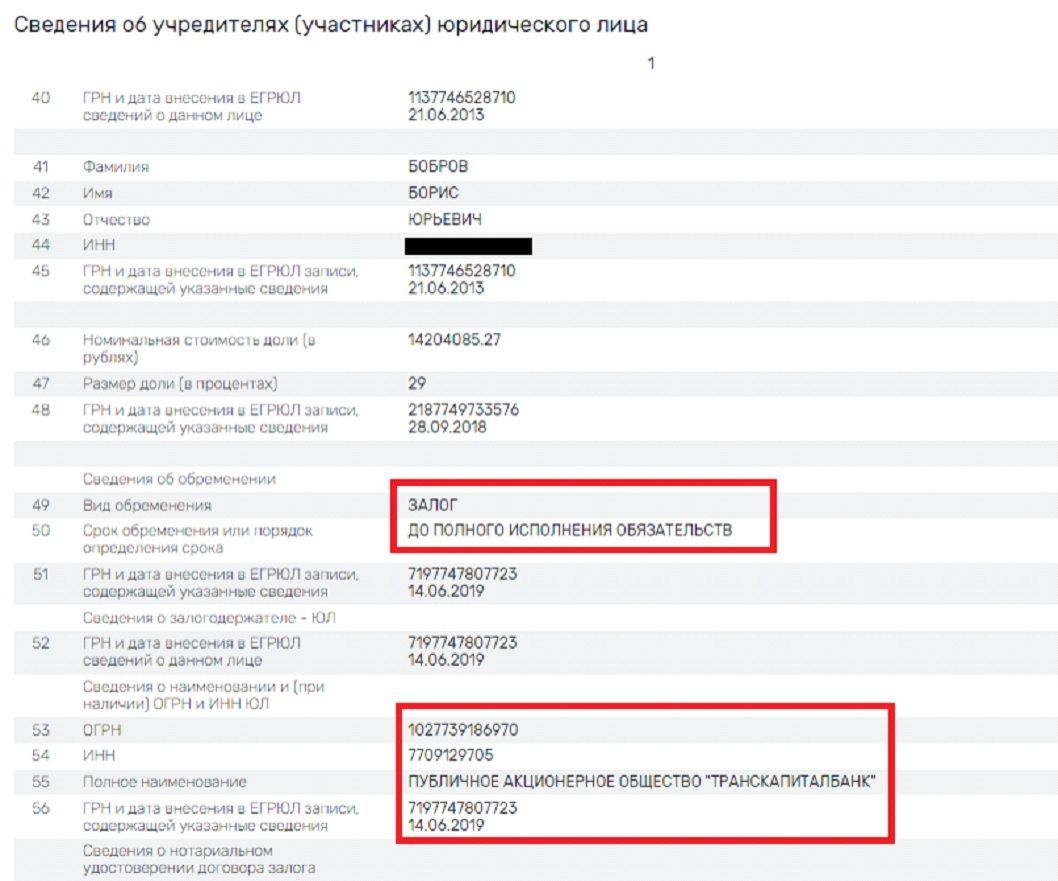

Interestingly, in 2018, the Central Bank, apparently, the charter to pour money into the TKB for the reorganization of the ITB, introduced changes to the reorganization plan that do not provide for additional funding. The pledge agreement with the owners of the Center for Innovative Medical Technologies LLC dates back to the second half of 2018. Apparently, Gryadova and her close circle suddenly crossed the golden stream of budget money, and by that time they had already generously "laid back," trying to help the business.

Interestingly, in 2018, the Central Bank, apparently, the charter to pour money into the TKB for the reorganization of the ITB, introduced changes to the reorganization plan that do not provide for additional funding. The pledge agreement with the owners of the Center for Innovative Medical Technologies LLC dates back to the second half of 2018. Apparently, Gryadova and her close circle suddenly crossed the golden stream of budget money, and by that time they had already generously "laid back," trying to help the business.

Now the money needs to be returned, and a cunning scheme with forged documents could come to the aid of resourceful legal bankers. We repeat - this is just a version.

But the above information raises such thoughts. By the way, back in 2019, The Moscow Post wrote that there could be financial claims against the bank in the amount of 1 billion rubles. With such a Damocles sword, really, you need to "creative."

If we look at the finances of the TCB itself, then since the beginning of the year, with an increase in the profitability of assets and capital, there has been an increase in overdue debt, and all the most important credit ratios have been in the red zone. Who will help Gryadova and TKB this time - financial support from the state, or a cunning "multi-move" to force debtors to fulfill their obligations ahead of time?

If we look at the finances of the TCB itself, then since the beginning of the year, with an increase in the profitability of assets and capital, there has been an increase in overdue debt, and all the most important credit ratios have been in the red zone. Who will help Gryadova and TKB this time - financial support from the state, or a cunning "multi-move" to force debtors to fulfill their obligations ahead of time?

.jpg?v1637643547)

.jpg?v1637643547)