Could Sberbank's money, with the participation of German Gref, be withdrawn through deliberately bad loans to the companies of the Israeli bankrupt Eliezer Fishman?

The Triumph Mall shopping center in Saratov moved away from Sberbank to the structure of the investment company Central Properties and the Aptekarsky company.

The first relates to the interests of Denis Stepanov and Sergei Egorov, who closely cooperate with Roman Timokhin's MR Group and are connected through business with the son of Anatoly Kozeruk, head of HC GUVS Center, one of the notable general contractors of Moscow construction projects. The Moscow Post has written in detail about these people - and repeatedly.

"Aptekarsky" is managed by ZPIF "Argos". This company is associated with the Adamant holding of Vladimir Golubev, known in certain circles as Barmaley. Back in the 80s, Golubev received a criminal record for robbery, robbery and theft.

Earlier, the mall belonged to the Investment and Mortgage Company, whose beneficiaries were not disclosed. Sber was her collateral creditor. Apparently, due to the financial difficulties of IIK, he sold the mall.

Who and how could get rich on the deal - the correspondent of The Moscow Post in the Saratov region understood.

Fishman caught a fish

Before the Sber structure received it, the Investment and Mortgage Company belonged to the Cyprus offshore company MALL PROJECT KO. LIMITED. The post of director of this company was at one time held by Roman Rosenthal. He is called the "new Russian billionaire". This is one of the highest paid Israeli top managers.

He holds the post of director of the development company Mirland Development Israeli businessman Eliezer Fishman. The latter was declared bankrupt in 2017. At the same time, according to the authors of the site MIGnews.com he allegedly tried to hide 100 million euros in Europe, and hid his assets by buying real estate in Germany. How much he could have left is an open question.

Fishman is known in the market as a person who does not like to pay off his obligations.

In 2008, Mirland Development's accounts were seized just because of this. The restrictions were lifted only when the Israeli corporation Fishman Group vouched for the firm, which, as you might guess, belonged to Mr. Fishman.

The guarantee of the businessman is very doubtful. As the owner of Home Center, which in 2013-2014 stopped servicing MDM debt and went into bankruptcy, he did not fulfill the requirements of creditors who applied to him as a guarantor, which is why the bank went to court.

In 2016, the financial situation in the company reached such a critical mark that Fishman risked losing control over it. Bondholders were going to exchange them for shares in the firm. There were no other press reports. I must think Fishman managed to keep the asset. As you can see, the entire system of his business is based almost on a pyramidal set of debts, some of which, one must think, cover others.

Gref savior

In 2016, Mirland Development Corporation plc overdue a payment on a bank loan it had raised to develop one of its malls and started talking about restructuring.

It is not known which financial institution the company owes, but in 2022 we learned that Sberbank is selling the company's former asset, the Mirland shopping center in Saratov. So, I think, it was the patrimony of Herman Gref who repeatedly undertook to allocate "loans" to Mr. Fishman. Perhaps the main state bank helped Fishman "save" the company in 2016?

It was Sberbank that in 2013 opened the Mirland Development Corporation credit line in the amount of over 3 billion rubles. The sale of two shopping centers is unlikely to serve all of the bank's investments in Fishman. Which gives reason to think about the motivation of German Gref so generously to pour state funds into Fishman's company.

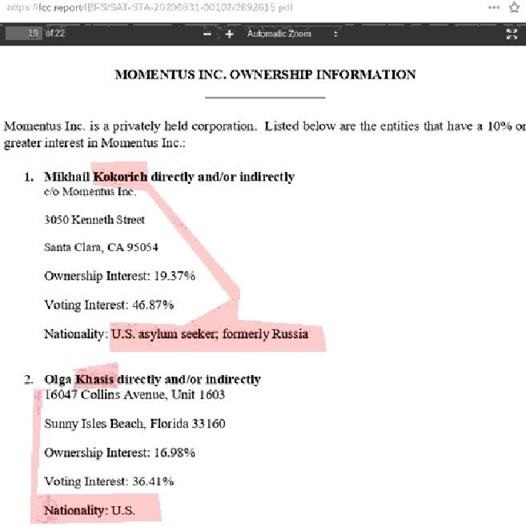

We know that Gref may have projects in other countries - for example, his ex-deputy Lev Khasis, who left for the United States after the start of the SVO, may be the beneficiary of the local construction company Momentus. This became known from the document, which shows that the company is registered with a certain Olga Khasis (also called the wife of Lev Khasis). Since the latter was Gref's "right hand", there is reason to believe that Mometus could have been acquired, among other things, at the personal expense of the country's chief banker.

Photo: Archive of The Moscow Post

So why wouldn't Gref have business connections or money in Fishman's funds? Maybe he has a stake in Mirland Development Corporation? Were Sberbank loans through Fishman's companies not "laundered" - including through the owner of the Triumph Mall shopping center?

No money, no quality

At the same time, from the point of view of the implementation of construction projects, Mirland is by no means famous for its cloudless reputation. In 2013, the Moscow Government decided to terminate the land lease agreement with it on Dmitrovskoye Shosse. Most likely because the company was going to build a skyscraper here, but never entered the site. And the state deducted money for renting, in fact, an empty plot. It's funny that no one was punished for the budget funds that flew into the pipe. Moreover, they were not even recovered.

In 2021, a scandal erupted when the structure of the Petra-8 company decided to build another house in the Triumph Park residential complex project, while the residents counted on the parking presented in the project.

Clashes took place not only in court, but also on the streets, and far from peaceful. In September, workers began fencing the territory of the future parking lot with a construction fence. Local residents made attempts to stop the work, as a result it came to the use of physical force. The police and an ambulance were called to the scene, later officers of the Russian Guard arrived.

Mirland in this situation even accused equity holders of losing 41 million rubles in profit. The case ended with the company selling the site to another equally scandalous developer Aquilon, having previously received permission to build an apartment building.

They say that the speaker of the Legislative Assembly of St. Petersburg Vyacheslav Makarov and the ex-head of the property relations committee Valery Kalugin, close to the former governor of St. Petersburg Valentina Matvienko, could help in this.

It seems that the Israeli bankrupt is now doing what he is trying to make in Russia through ties in government structures and not without the participation of Mr. Gref.

All for one

There were rumors on various Internet platforms where it was alleged that "Petrov's conversations (meaning St. Petersburg criminal authority - ed.) With Golubev were allegedly recorded - Barmaley, in addition to the mafia fraternity, was a companion of an arrested business colleague in the Moscow region. As follows from the same records, another member of Gennady Petrov's inner circle is the head of Sberbank German Gref, who credited the authority's enterprises on preferential terms".

Does the sale of Triumph Mall come from here to Golubev? With the second buyer, Sberbank also has everything, as they say in certain circles, "on ointments".

If you take a closer look at the assets of Denis Stepanov, you can see that he and his partners are actively using Sberbank's money, pledging their shares to him. Example: First LLC, where the shares of all founders are under the encumbrance of the state bank.

Photo: Rusprofile

At the same time, the company was previously registered with FLAGERVILLE INVESTMENTS LIMITED offshore. We do not hint at anything, but the conceived offshore jurisdiction is a sign of withdrawal of funds.

So, in the dry balance, we have the following picture: Sberbank, which received the asset of the Israeli bankrupt Fishman for debts, which for unknown reasons "clouded" loans, sold the asset to the authoritative Golubev and ambiguous Stepanov and Egorov. Whether the withdrawal of funds from the country's largest state bank can be hidden behind the transaction can be dealt with by law enforcement officers.

.jpg?v1691722962)

.jpg?v1691722962)