Does the owner of AFK Sistema stubbornly hide the true state of affairs?

As it became known to the correspondent of The Moscow Post, the Russian investment company AFK Sistema, which is in the top 20 in terms of product sales, reported for 9 months of 2024 under IFRS. Close attention has long been riveted to this multidisciplinary holding: after all, it is one of the most demanded companies on the securities market.

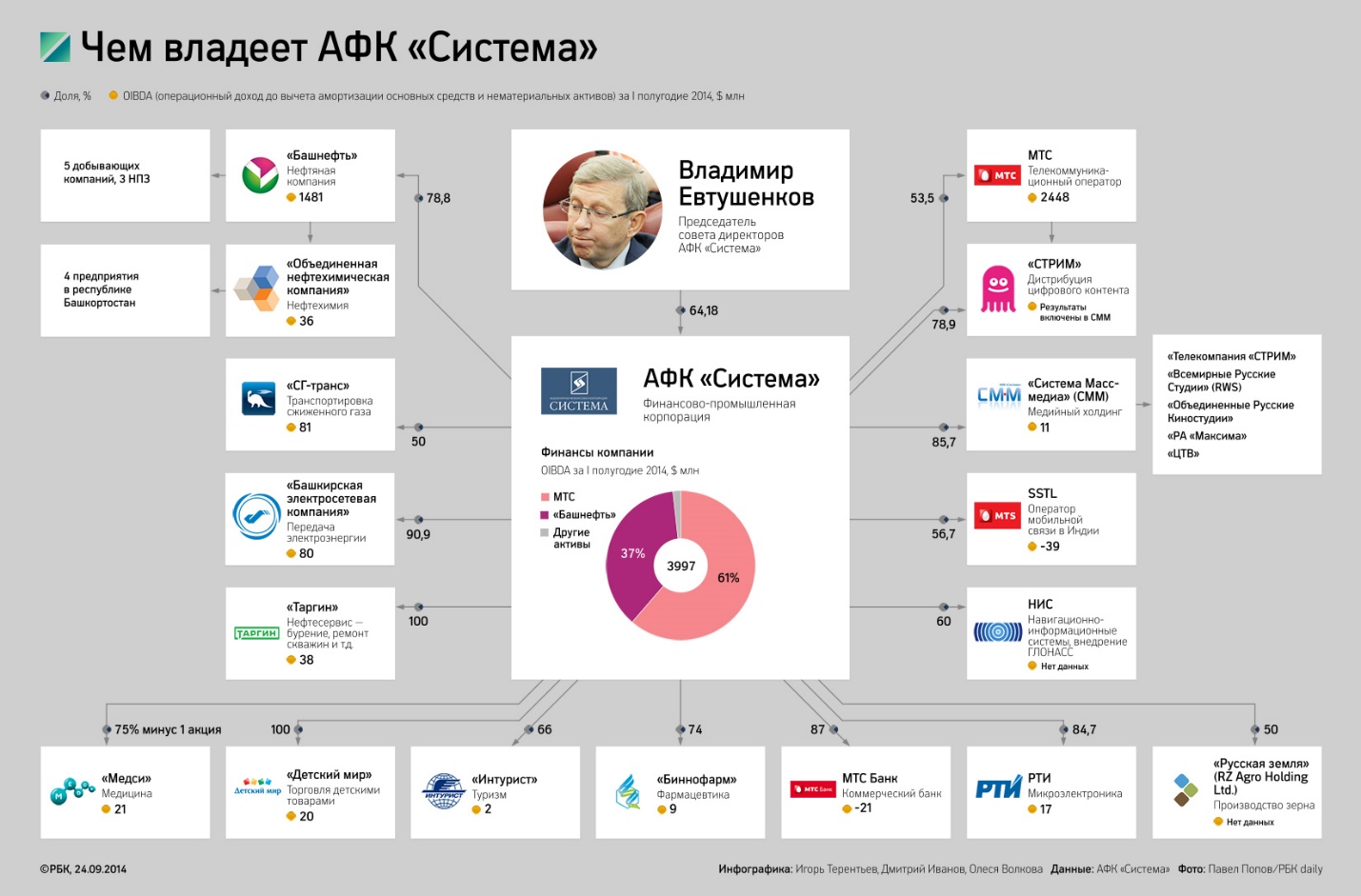

The holding employs about 150 thousand people, and the group's portfolio includes several hundred large companies - from MTS and Ozon to Intourist and Arkhyz.

The fortune of Mr. Yevtushenkov himself is $1.7 billion.

But there are persistent rumors in the market that things are not going very smoothly for the billionaire. And this was supposed to confirm the reporting, which the holding, as a public company, is obliged to make public. And the holding published this reporting, after which analysts concluded: "AFK Sistema shares do not look attractive to investors." It is reported by "Finam."

But this, as they say, is a blow below the pager!

Results weak

So, AFK Sistema presented IFRS financial results for the nine months of this year. And it demonstrated a decrease in profits amid an increase in the debt burden.

Net debt of the group during the third quarter of 2024 increased by 12.1%

Consolidated revenue for 9 months of 2024 increased by 20.1% YoY, reaching 888.3 billion rubles. And this revenue growth was demonstrated by all the main assets of the group.

Net profit for January-September months of 2024 decreased by 92% year-on-year and amounted to 1.8 billion rubles.

At the same time, in the third quarter of 2024, a loss of 2.6 billion rubles was recorded due to an increase in interest expenses against the background of an increase in debt and interest rates.

What Mr. Yevtushenkov owned in the recent past. Photo: https://s0.rbk.ru/v6_top_pics/media/img/9/40/284117313704409.jpg

During the third quarter of 2024, the group's net debt increased by 12.1% to RUB 1,335.2 billion, while the net debt of the corporate center increased by 12.6% during the reporting quarter, amounting to RUB 288.7 billion.

At the same time, 96% of the Group's consolidated financial liabilities are denominated in Russian rubles.

And analysts assess the results of AFK Sistema as weak, due to the high debt burden, a significant decrease in profit since the beginning of the year and a loss in the 3rd quarter due to an increase in interest expenses. The company did not disclose the full financial report for 9 months of 2024, however, according to the financial statements for 6 months, financial expenses exceeded the group's operating profit.

Segezha Group: high debt burden

In addition to AFK Sistema itself, the high debt burden is even more acute for the Segezha Group.

Recall that Segezha Group, in which Mr. Yevtushenkov has a 62.2% stake, decided to place shares worth 101 billion rubles to reduce its debt of 143 billion. by closed subscription. In addition to existing shareholders and funds, creditors can participate in the process, and the placement should allow the company to return to the implementation of investment projects. That could support a falling share price. Today, Segezha's share capital consists of 15.69 billion shares. If the additional issue is implemented, the authorized capital can grow to 71.8 billion shares.

Photo: Gazpromabank Investments

The company has been operating at a loss for the last 2 years: and for 9 months - 15 billion losses. The share price fell by 80% since the last IPO in 2021, the share price then amounted to 8 rubles, the additional issue was announced at 1.8 rubles per share.

And at the end of November, the board of directors of Segezha Group announced the convening of an extraordinary meeting of shareholders on the issue of an additional issue of shares.

The extraordinary general meeting of shareholders will be held in absentia on December 26, 2024.

Thus, SPO Segezha Group may lead to the diversion of funds of AFK Sistema, which will have an additional negative impact on the financial performance of the group.

In addition to Segezha Group, a high debt burden is also characteristic of other assets of AFK Sistema, including MTS, Etalon, OZON, Binnopharm Group, and therefore the likelihood of the holding receiving high dividends from assets is greatly reduced.

And against the background of a correction in the stock market and a high rate of return required by investors due to the high rate of the Bank of Russia, the listing of non-public assets of AFK Sistema on the stock exchange is in question.

But Mr. Yevtushenkov continues to puff out his cheeks?

Cobblestone neck

Judging by the official reporting, Sistema's affairs seem to be in order - revenue growth for 9 months + 20.1%, OIBDA + 12.6%, net profit + 1.8 billion rubles.

But over the past 3 months, the holding has recognized a loss of 2.6 billion rubles.

And this loss can be a cobblestone around the neck of a drowning man.

Evil tongues say that billionaire Yevtushenkov has been working on debt for a long time. And it began back in 2023, when a deal was concluded to buy the Norwegian hotel chain Weenas.

Sistema continued to make new acquisitions in the Krasnodar Territory and Dagestan - by 1 billion rubles.

3.6 billion rubles. AFK Sistema's subsidiary - Ozon - invested in Ekom Bank, 4.6 billion rubles in Etalon, 450 million rubles - in the mineral waters of Arkhyz, etc.

Mineral waters of Arkhyz. Photo: https://iconlife.ru/images/Arkhyz_X_Run_Alpindustria_Trail_3.jpg

And there is a persistent feeling that Yevtushenkov's structures simply bought everything that is sold, including 75% of Crystal Fish, Inter Forest Rus LLC, processor manufacturer Elbrus, etc.

But Yevtushenkov's business empire - again - is being let down by the head asset - the Segezha holding. And the billionaire Yevtushenkov closed most of the transactions with borrowed money, including those received from the IPO.

Recall also that Segezha Group energetically conducted business in Europe - and this gave rise to blame Yevtushenkov for the economy his companies are developing.

And the billionaire paid for it. He himself is under sanctions. And 7 paper packaging plants in Denmark, the Czech Republic, Germany, the Netherlands, Italy, Turkey and Romania had to be sold.

The deal was done on market terms, but what are those terms?

This story is still shrouded in thick fog. Writes about this "Version."

But it became known that in unfriendly countries, Mr. Yevtushenkov earned about 14 billion rubles. in year.

And now, when the bet on the European market is lost, only the logistics costs of the group have doubled, to 16 billion rubles.

How will AFK Sistema get out of the financial crisis?

This is a mystery covered in thick darkness...

.jpg?v1733200416)

.jpg?v1733200416)

.jpg?v1743692146)

.jpg?v1743691324)

.jpg?v1743689148)

.jpg?v1743686883)

.jpg?v1743686018)

.jpg?v1743684168)

.jpg?v1743683267)

.jpg?v1743682312)

.jpg?v1743680756)

.jpg?v1743679505)

.jpg?v1741274575)

.jpg?v1741069432)

.jpg?v1741097205)

.jpg?v1741252674)

.jpg?v1741166249)

.jpg?v1743671171)

.jpg?v1743662257)

.jpg?v1743601777)

.jpg?v1743667485)

.jpg?v1743666148)

.jpg?v1743658458)

.jpg?v1743597910)

.jpg?v1743590109)

.jpg?v1743584682)

.jpg?v1743510616)

.jpg?v1743492235)

.jpg?v1743488844)

.jpg?v1743414043)

.jpg?v1743407276)

.jpg?v1743165464)

.jpg?v1743087614)

.jpg?v1743079586)

.jpg?v1743074032)