The collapse of the Stavropol Hydrometallurgical Plant and related enterprises revealed a scheme according to which billions of rubles were spent from the plant to a company affiliated with the oligarch Albert Avdolyan. In December, experts will have to evaluate the scheme. From somewhere pulled a new criminal case?

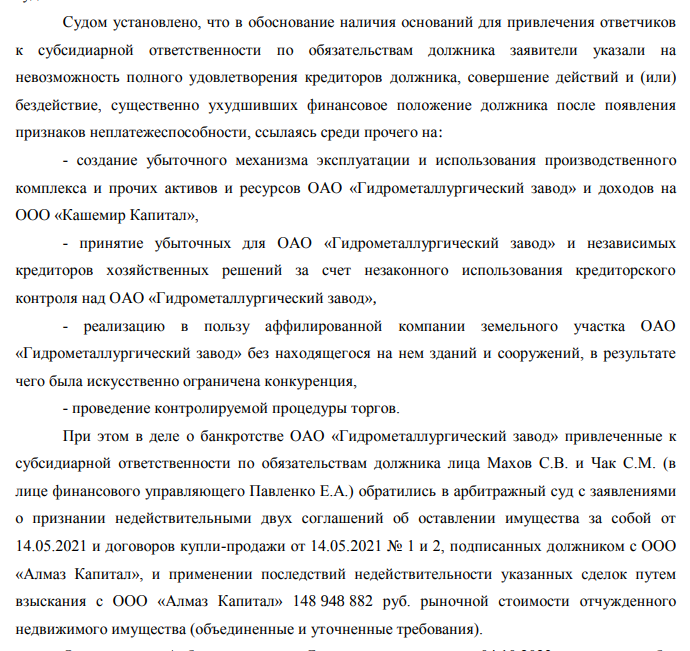

On December 9, the Stavropol arbitration will answer a number of questions regarding a comprehensive agreement on the processing of tolling raw materials of 10.10.2018. Under it, billions of rubles were withdrawn from the GMZ to the accounts of Cashmir Capital LLC.

At the same time, against the background of the redistribution of profits from the plant's activities in favor of Cashmir Capital LLC, the current and registered debts of the plant remained outstanding. The court doubted the conscientiousness of the beneficiary, whom, despite the pads from the screens, Avdolyan recognized.

The details were found out by the UtroNews correspondent.

Recall that in 2018, Albert Avdolyan's group of squires acquires a number of related and financially troubled Stavropol enterprises - OJSC Hydrometallurgical Plant (GMZ), CJSC Southern Energy Company and Intermix Met LLC.

At the same time, the right to claim debt on a Sberbank loan was redeemed, to which there are also questions. The courts have repeatedly sounded that the former beneficiaries allegedly withdrew money not for the needs of enterprises, thereby finishing them off.

Thus, Avdolyan's squires became controlling persons and at the same time holders of large debts, which no one claimed until the acquisition of shares was appealed to the courts. After all, it turned out that the shares were sold on the cheap, below the market price.

Despite the fact that other persons were legally buyers of Stavropol enterprises (Andrey Korobov, a native of Rostec state corporation, the head of YATEK Avdolyan, was the formal buyer of YUEK shares), the court recognized Avdolyan as the single beneficiary. It was his words that the media quoted in 2022 when it became known that the oligarch allegedly sold assets to top managers.

He stated that the GMZ was raised "from ruins and nothing threatens him." But in fact, none of the ruins of the GMZ and related legal entities raised, otherwise how to explain that they are still bankrupt?

Photo: ras.arbitr.ru

Meanwhile, bankruptcy cases revealed many schemes and financial transactions, which raised questions that, in our opinion, investigators should ask all participants in this Marlezon ballet. After all, in fact, it turned out that large sums were withdrawn to firms associated with Avdolyan. UtroNews spoke in detail about part of the tranches earlier, mentioning 400 million rubles from YUEK and Cashmir Capital LLC among the recipients.

It was Cashmir Capital LLC that became the recipient of profit with GMZ under a very interesting agreement - a comprehensive agreement on the processing of tolling raw materials from 10.10.2018. The contract was concluded almost immediately after the purchase of the enterprise and 9.447 billion rubles of the plant's revenue from the sale of manufactured products were spent on the LLC's accounts. That is, in fact: the plant remained a kind of center of losses, and new players in the scheme became such centers of profit. That's the whole secret of raising enterprises from their knees?

Photo: ras.arbitr.ru

The bankruptcy trustee has been trying to challenge this complex agreement for four years already in order to apply the consequences of the invalidity of the transaction and return at least a part of 9.4 billion rubles to the GMZ accounts. An examination was even carried out in the case, which the experts later recalled, referring to some identified technical error.

By the next meeting on December 9, experts will have to announce the results of the new examination. It is only embarrassing that Cashmir Capital LLC requested it.

Photo: ras.arbitr.ru

What is Cashmere Capital LLC, which, together with Avdolan, demanded to bring to subsidiary liability for GMZ debts? At the same time, the issue of subsidies has been suspended until the fate of a number of agreements that are being disputed, including a comprehensive agreement with LLC, is resolved.

Photo: ras.arbitr.ru

Photo: ras.arbitr.ru

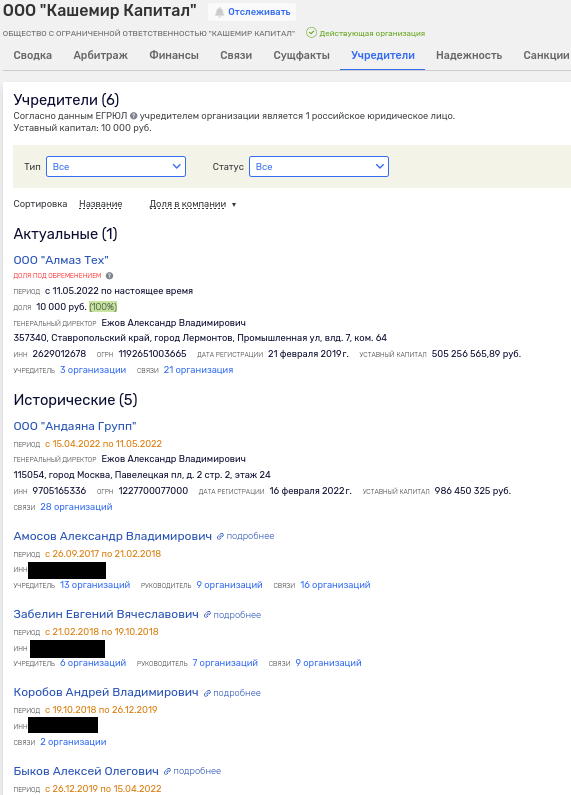

So, Cashmir Capital LLC was established in September 2017 to operate in the field of law, but in 2019 the company changed its purpose to wholesale of fertilizers and agrochemical products. 2023, when assets in the Stavropol Territory were already lost, the company ended with a large loss - 442 million rubles.

Over the years, various proxies of Avdolyan were noted among the owners of the LLC, including Evgeny Zabelin, the former director of Sakhagazsintez-Nedra LLC, which belonged to YATEK Avdolyan, Andrei Korobov, director of the same YATEK, Alexander Amosov and Alexey Bykov, with whom the offshore oligarch Sparkel City Invest LTD was involved in the collapse of the MRSEN energy holding. In the list of owners from April to May 2022, Andayana Group also appeared, where among the owners were the same Zabelin, Korobov and Bykov.

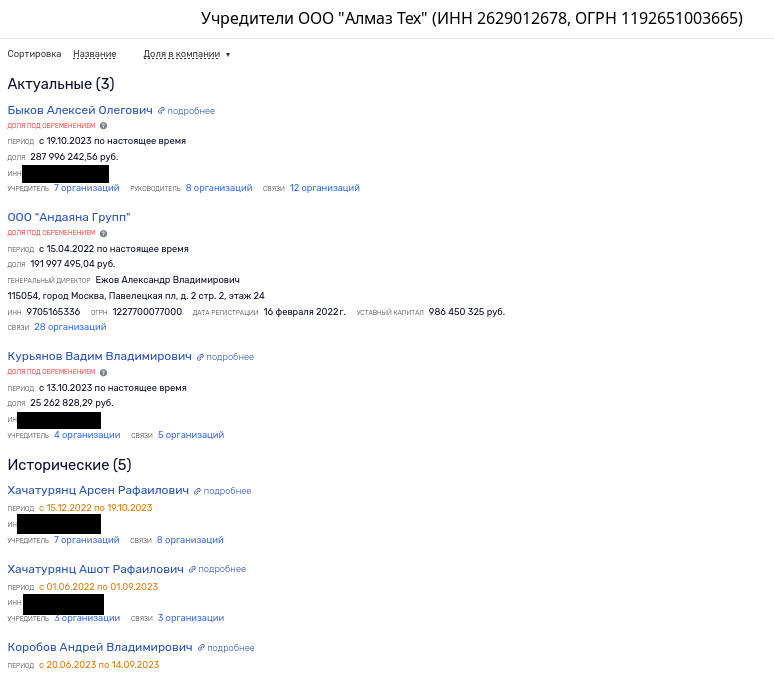

Today, Cashmir Capital LLC belongs to Almaz Tech and is burdened with collateral in the BBR Bank, among the shareholders of which Avdolyan's longtime acquaintance Dmitry Gordovich was noted. The latter was also associated with the history of MRSEN, and the bank was noted in the transaction related to the transfer of 100 million rubles to the Latvian bank JSC Citadele Banka. A chain of offshore companies flashed in history.

Photo: rusprofile.ru

The owner of Almaz Tech LLC previously also shone Korobov, and today the above Andayana Group and Alexey Bykov are among the controlling owners.

Photo: rusprofile.ru

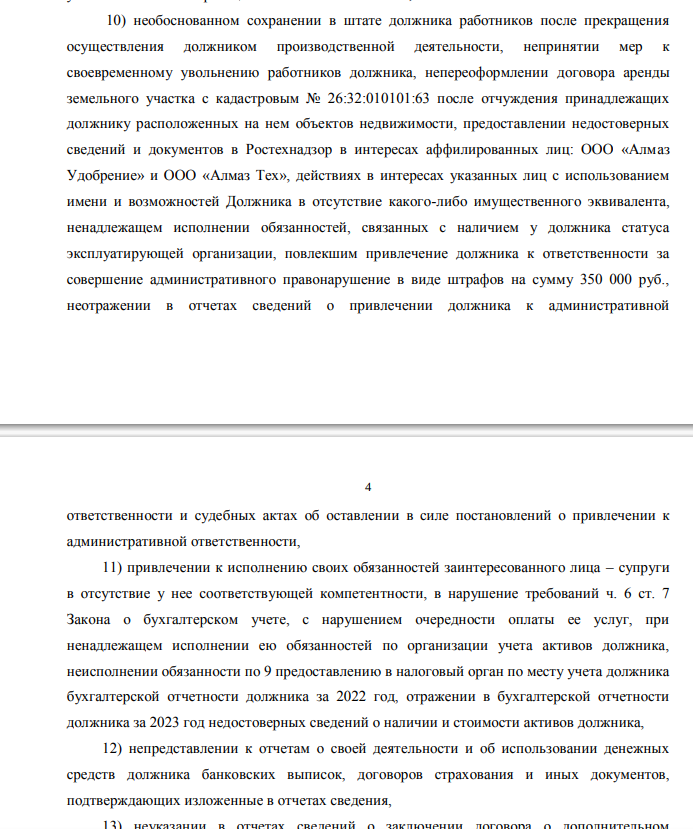

An interesting fact: in October 2024, the court received a complaint against the bankruptcy trustee, who, among other things, was accused of acting in the interests of a number of companies, including Almaz Tech. A hearing on the complaint is scheduled for late November.

Photo: ras.arbitr.ru

Despite the numerous ambiguous financial schemes opened, there is still no criminal case with a well-known set of defendants in the case of the collapse of Stavropol enterprises.

Neither the tax authorities nor the investigators had any questions for Avdolyan. Although, in our opinion, there is something to ask.

The unsinkability of the oligarch, however, has long been explained. Close friendship with the influential head of the state corporation Rostec Sergey Chemezov, whose subordinates Avdolyan sheltered in his business, this is not a ram sneezing to you...

.jpg?v1728966705)

.jpg?v1728966705)