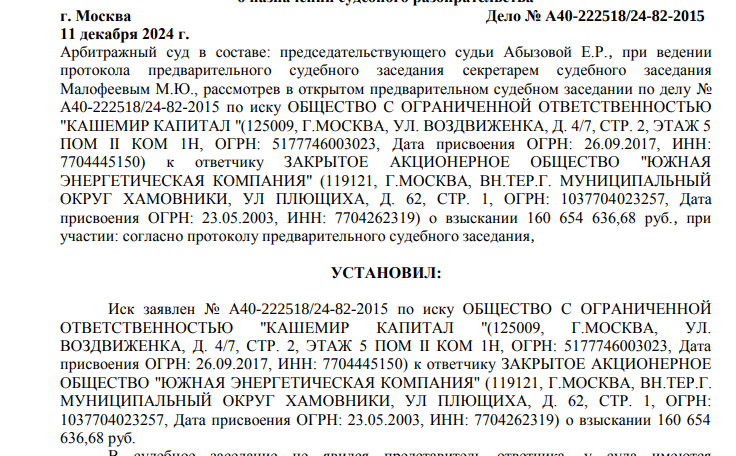

Oligarch Albert Avdolyan and his team, which participated in the collapse of Stavropol enterprises, will not disengage from the energy enterprise, which provides heat to Lermontov. Almost 190 million rubles are required for the debts of another company under a surety agreement with YUEK, although these debts already have many questions and are trying to withdraw assets.

CJSC Southern Energy Company, which is affiliated with the Hydrometallurgical Plant, cannot get rid of the murky history of lending to GMZ.

What is happening around the heat supply company, the UtroNews correspondent understood.

Recall that in 2018, having collected loans, the shareholders of GMZ and YUEK Sergey Chuck and Sergey Makhov merged their companies on the cheap with Albert Avdolyan's proxies. At the same time, another group associated with the same oligarch bought from Sberbank the right to claim debts on a loan that dragged the GMZ to the bottom.

While the enterprises were taxing the oligarch's squires, a whole series of muddy (in our opinion and not only in our opinion) transactions were carried out. Here you have the transfer of more than 9 billion rubles from the GMZ accounts to the accounts of Avdolyanovsky LLC Cashmir Capital under a concessional transaction, the legality of which is now being decided in court, and transfers of millions of rubles to affiliated firms, and the abandonment of expensive GMZ assets as compensation. And this is just the tip of the iceberg.

When Makhov and Chuck were declared bankrupt, transactions to drain shares for a penny were challenged in court and this property returned to the balance of debtors.

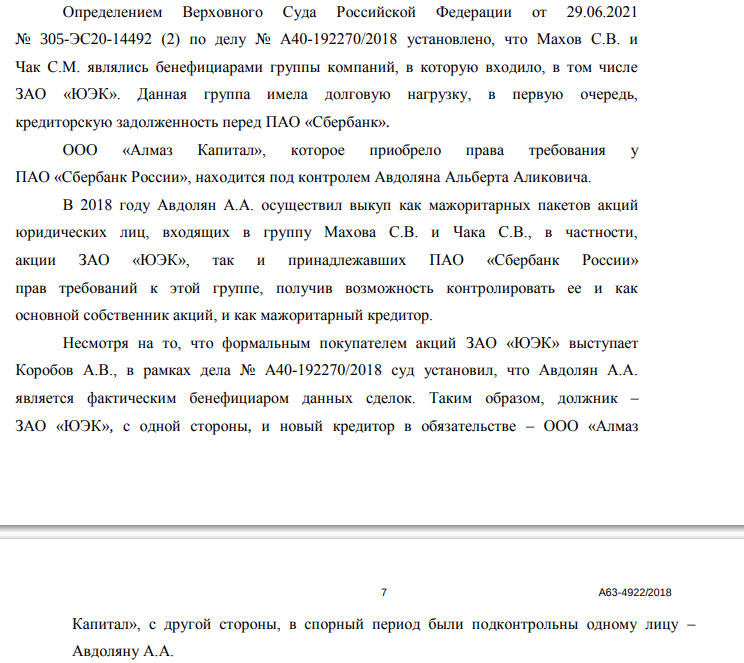

Then the second part of the oligarch's team became more active, which went to court to demand a loan debt. The court repeatedly refused this, pointing to the affiliation of both the debtor and the creditor, and also noted the fact that the debts were not declared earlier, but only after the sale and purchase of shares was declared invalid, which smacks of an attempt to withdraw liquid assets.

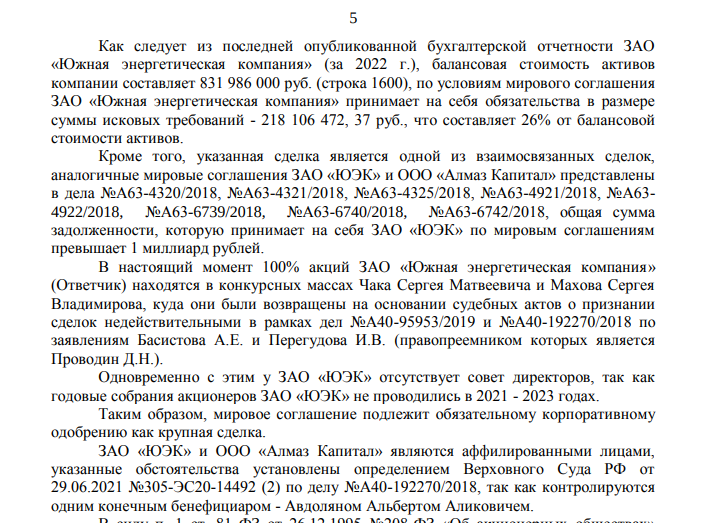

A certain settlement agreement did not work, according to which YUEK allegedly assumed a billion of GMZ debt as a guarantor. But the court did not accept this document - after all, the board of directors did not approve it, and in general at that time this body was not functional.

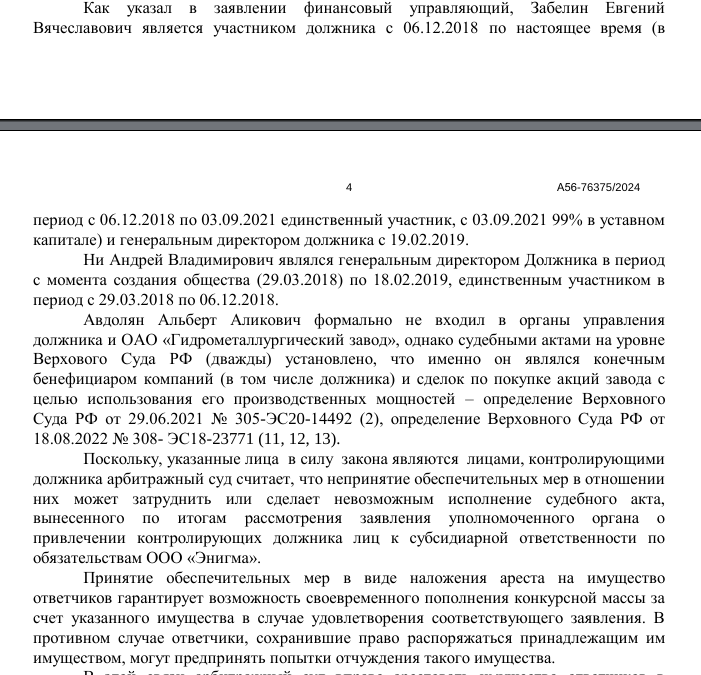

Today, the buyer of GMZ shares - Enigma LLC, taken under supervision as the first stage of bankruptcy, is required to pay more than 690 million rubles of the real value of the shares (for the period of ownership). As part of this case, the assets of Avdolyan and his proxies were seized. The very issue of subsidiary liability will be considered in February 2025.

This is perhaps the first swallow of claims against the oligarch, despite the fact that in court he was recognized as the real beneficiary of GMZ and YUEK a few years ago.

Photo: ras.arbitr.ru

Photo: ras.arbitr.ru

In the materials of the courts, it was clarified that, despite the fact that the transaction on UEC shares was carried out by Andrei Korobov (as a buyer), A.A. Avdolyan is the actual beneficiary.

UtroNews previously reported that Korobov is the general director of YATEK, part of the block of shares of which belongs to Avdolyan. In addition, Korobov previously worked in the Rostec division. And the state corporation and its permanent leader Sergei Chemezov are a longtime benefactor of the oligarch. For example, Chemezov, together with his wife Ekaterina Ignatova, are members of the board of trustees of the New House Foundation Avdolyan, and immigrants from the state corporation on an ongoing basis flash in Avdolyan's division.

Let's return to the Stavropol enterprises.

If GMZ is currently in bankruptcy, then YUEK, despite the unprofitability of 2023 by 124 million rubles, is still afloat. Although in 2018, creditors twice announced plans to file for bankruptcy of YUEK.

It is not surprising that Avdolyan and his team are still trying to rip off debts on GMZ loans from YUEK. Earlier, for example, they tried to get more than 1.2 billion rubles from the heat supplier, but lost the courts.

Photo: ras.arbitr.ru

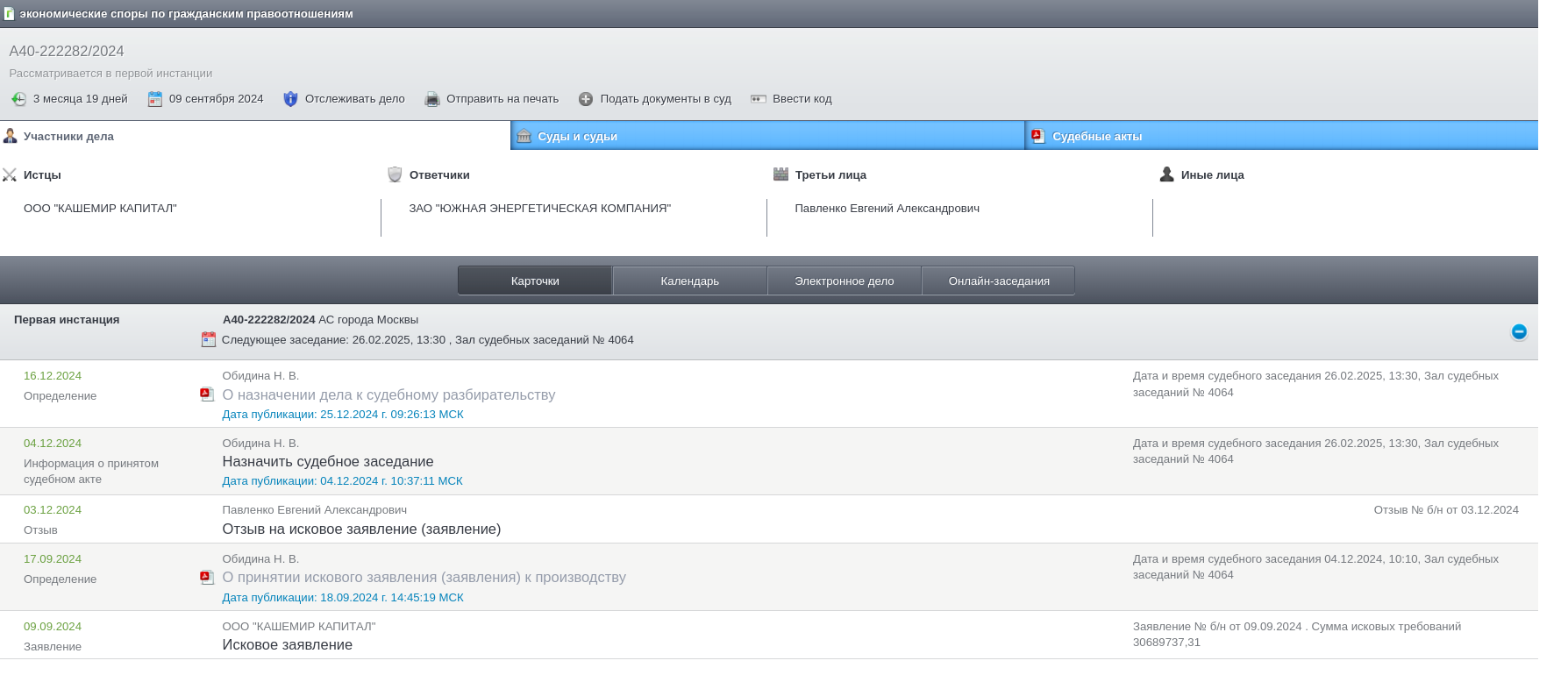

Then the Kashmir Capital LLC already mentioned by us went to court with separate claims against YUEK, which are still under consideration. In one case, the LLC demands - 160.6 million rubles. Such amounts for the unprofitable YUEK are large and, in our opinion, can lead to problems with the heating season. Moreover, over the years, more than 1,000 government contracts for 633 million rubles as a supplier and about 500 for 570 million rubles as a customer have been carried out through this company. It provides services to strategic and social enterprises. But Avdolyan's team seems to care little.

Photo: ras.arbitr.ru

Photo: ras.arbitr.ru

At the same time, it was directly established in court that Almaz Capital LLC, associated with Avdolyan, selectively makes claims against debtors belonging to the same group, actually increasing UEC's debts to the team, noting that in 2023 they amounted to more than 2.5 billion rubles and were secured by a pledge of property.

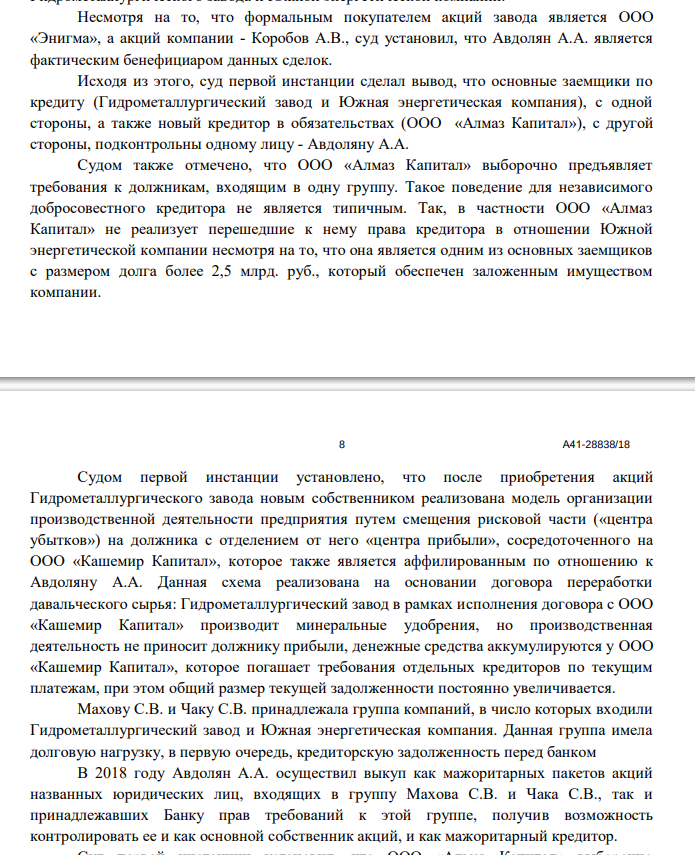

At the same time, at the GMZ, the new owner has implemented a model for organizing the production activities of the enterprise by shifting the risk part ("center losses ") to the debtor with the separation from him of the" profit center "focused on Cashmere Capital LLC, which is also affiliated with A.A. Avdolyanu

Photo: ras.arbitr.ru

Watch your hands: 9 billion rubles were sent from the profit center to Cashmere Capital, associated with Avdolyan, at the same time this company arises as a certain creditor of YUEK and requires more than 190 million rubles. In the materials of the new cases, there are no indications on the basis of which the requirements arose (only a note on loans and borrowings), but if we are talking about the assignment of rights from Almaz Capital LLC to Cashmere Capital, the picture smacks of an increase in the debt mass, so that later, probably, withdraw liquid assets before the bankruptcy of UEC. And taking into account that the debts are secured by the pledge of liquid property, it can be taken as compensation. There is experience.

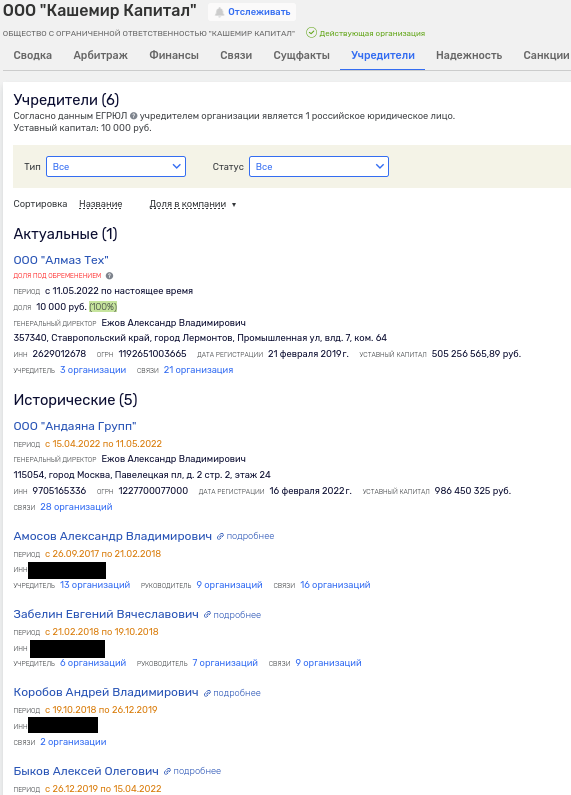

At the same time, Cashmir Capital LLC is also affiliated with Avdolyan.

The owner of the LLC is Almaz Tech, but the share is burdened with collateral in the BBR Bank, among the major shareholders of which is the oligarch's longtime partner, Dmitry Gordovich.

Gordovich appeared in the scandalous collapse of the MRSEN energy holding, and the bank participated in the transaction related to the transfer of 100 million rubles to the Latvian bank JSC Citadele Banka. A chain of offshore companies was also involved there, which had already aroused the interest of the relevant authorities.

The Almaz Tech company at one time belonged to the already mentioned Korobov, and today it is owned by Andayana Group LLC and Alexei Bykov (they control the asset). The shares of the latter are also pledged by the BBR to the Bank.

Bykov is Avdolyan's longtime partner, which has been proven more than once in MorningNews publications, and among the owners of Andayan Group is a whole group of Avdolyan squires, including Bykov and Korobov. The connection, as they say, is obvious.

Photo: rusprofile.ru

It seems to us that the arrest of Avdolyan's assets is the first progress towards a criminal case on the history of the collapse of Stavropol enterprises, which, in our opinion, has long smelled badly. There are not few episodes with dubious ins and outs and their number is only growing. No matter how you have to, then collect money from YUEK offshore.

.jpg?v1736396633)

.jpg?v1736396633)